2026 State Of

Value Creation

Benchmark.

How value creation is evolving across

private equity, growth equity and venture capital

in a leaner, more complex market.

The Evolution of Value Creation

Core Expectation

Active, Hands-on Support

2026 Benchmark

The 2026 State of Value Creation Benchmark, produced by York IE in partnership with the Magnuson Center for Entrepreneurship at Dartmouth, captures how value creation teams are structured, where they are focused, and how the operating model is evolving across private markets.

Access the Intelligence

Receive the full PDF, including detailed insights and data tables.

- Immediate PDF download

- Key insights into the future of value creation

Why Value Creation Matters Now

Market conditions have fundamentally changed the investor playbook. Longer exit timelines, heightened competition for deals, and increased scrutiny from LPs have raised the bar for post-investment performance.

Portfolio companies are expected to grow efficiently, professionalize faster, and build durable operating foundations, often with fewer resources than in prior cycles.

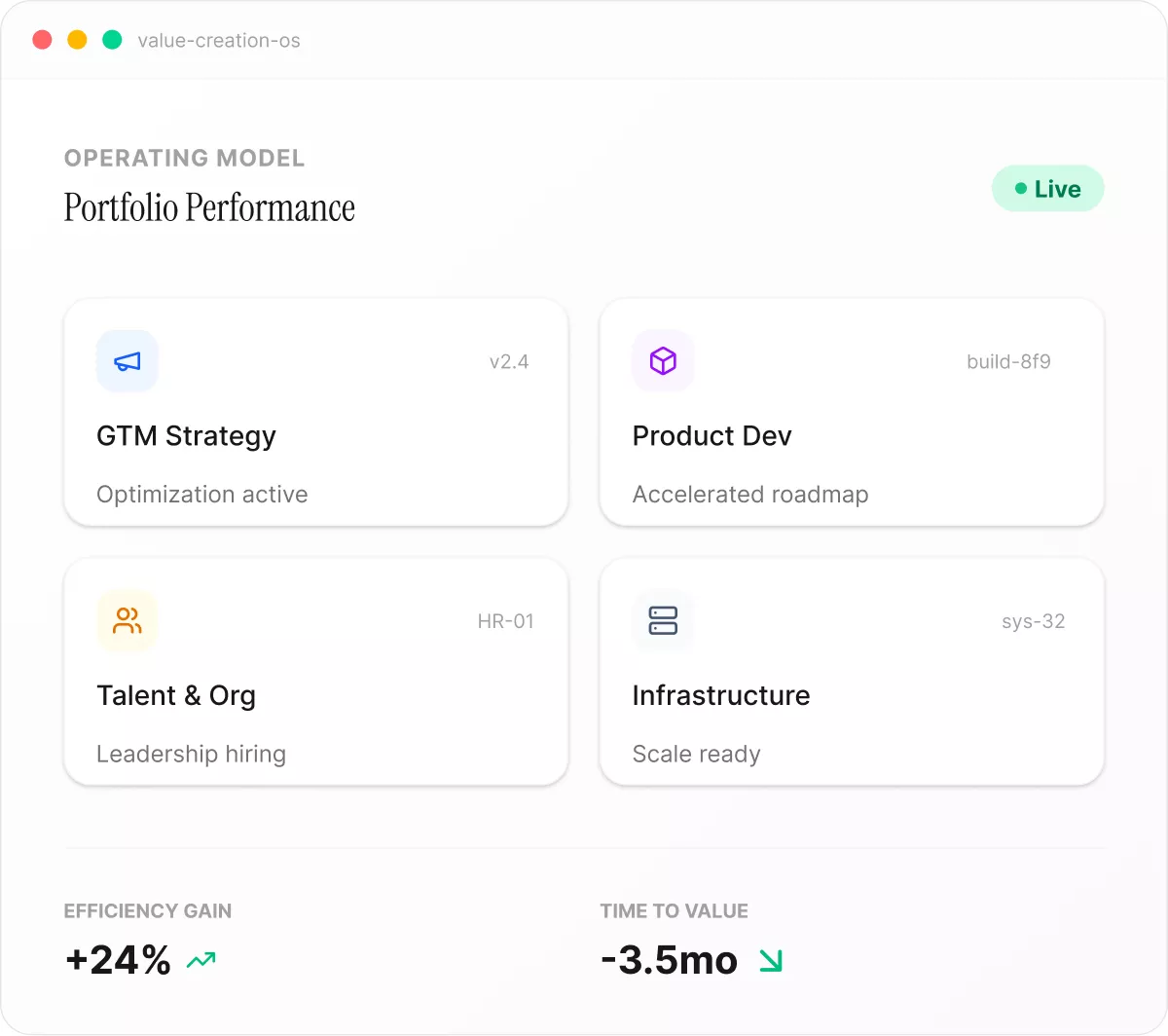

This shift is reflected directly in the data. Value creation teams are being asked to do more than ever before, spanning GTM, product development, talent, infrastructure, and AI adoption, frequently with limited headcount and tooling.

The Five Most Important Findings

Value creation teams are lean – and under pressure.

Only 17.9% of respondents say they are very confident their team has sufficient resources to meet KPIs, underscoring a structural capacity gap across the industry.

Respondents reporting “high confidence” in current resource levels.

GTM is the dominant lever of enterprise value.

Across nearly every question, GTM and Revenue Operations emerge as the focal point of value creation activity:

- 74.6% spend the most time on GTM

- 67.2% rank pipeline generation as their top priority

- 44.8% say GTM drove the most enterprise value in the last 24 months

Execution challenges are moving upstream into product and infrastructure.

As GTM systems mature, friction increasingly surfaces in product delivery and technical foundations. Nearly 30% cite product delivery and infrastructure as top challenges.

Top Operational Bottlenecks

AI is the most important opportunity — and the largest gap.

The disparity between AI ambition and execution is stark. While viewed as the top driver of future value, over a third of respondents identify it as their most underserved operational area today.

35.8%

say AI and automation are currently the most underserved areas.

believe Generative AI will have the "greatest impact" on future value creation.

Leadership and talent remain critical execution multipliers.

Leadership capability consistently emerges as both a constraint and a value driver, reinforcing that execution increasingly hinges on people — not just strategy.

C-Suite Assessment

Top priority for Year 1

Talent Augmentation

Fractional leadership support

Voice of Our Partners

Leaders across the industry share more on the current

and future state of value creation.

The Industry’s New Operating Model

Growth at all costs

Historically, firms relied on high-touch, bespoke engagement to support portfolio companies.

The Efficiency Pivot

While this approach remains prevalent – 89.6% still rely primarily on direct engagement – it is becoming increasingly difficult to scale as portfolios grow and mandates expand.

Algorithmic Operations

The next generation of value creation will be defined by more systematized approaches: standardized playbooks, integrated operating frameworks, AI-enabled workflows, and real-time portfolio insights.

Download the Full 2026 State of

Value Creation Benchmark

Get access to the full report, including detailed data, analysis, and insights

on how value creation is evolving across private markets.