Talkdesk, a cloud based customer experience platform, announced they have just completed a $143M Series C round led by Viking Global Investors & Threshold Ventures. This latest round brings Talkdesk’s total funding to $268M since 2011; in addition, Talkdesk has added new investors like Franklin Templeton & Willoughby Capital to an already impressive list of outside investors.

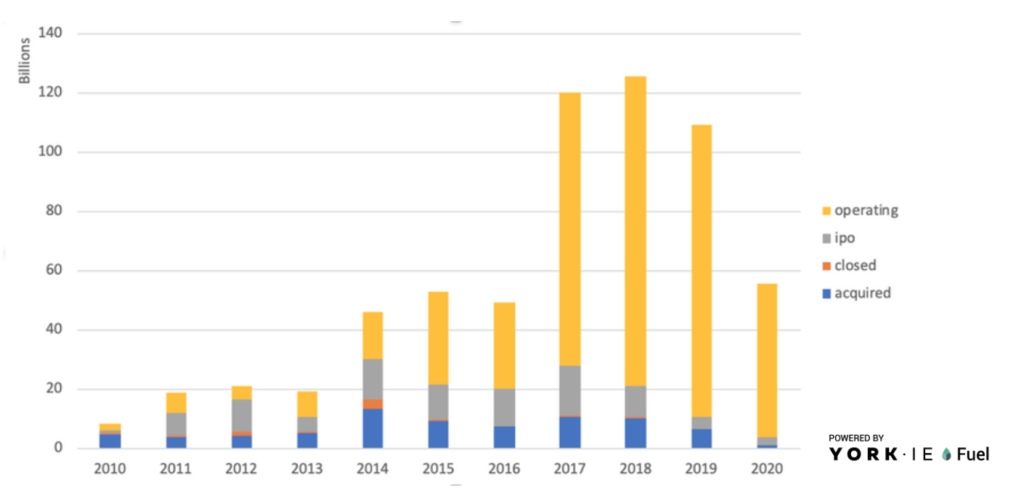

The graph shows that companies have been raising larger funding rounds over the past decade, reaching a peak in 2018. What this tells us is that despite raising large amounts of capital, more companies are choosing to stay private rather than IPO. Given Talkdesk’s ability to quickly raise capital and perform well in a market with significant tailwinds an IPO would seem likely, our data tells a different story. Taking a deeper look into the graph above we chose to show what percentage of these companies have remained private, IPO’d, closed or been acquired.

The graph shows that companies have been raising larger funding rounds over the past decade, reaching a peak in 2018. What this tells us is that despite raising large amounts of capital, more companies are choosing to stay private rather than IPO. Given Talkdesk’s ability to quickly raise capital and perform well in a market with significant tailwinds an IPO would seem likely, our data tells a different story. Taking a deeper look into the graph above we chose to show what percentage of these companies have remained private, IPO’d, closed or been acquired.

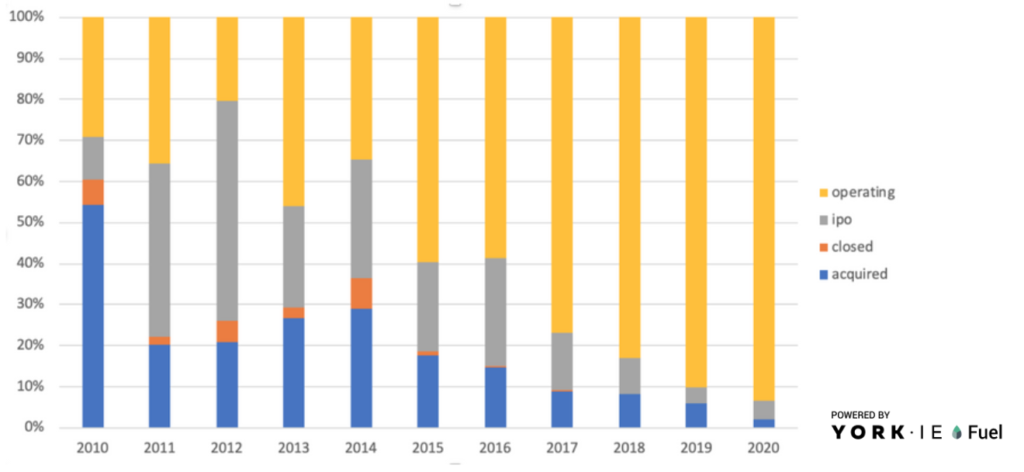

Once again, our data shows that a growing number of companies are choosing to remain private following large funding rounds. This could indicate that there is a backlog of companies that closed large funding rounds and are waiting to IPO in the near future. Regardless of Talkdesk’s intent to IPO, closing out a $143M Series C round is a testament to investor confidence in the company’s ability to continue being a leader in the industry.

Once again, our data shows that a growing number of companies are choosing to remain private following large funding rounds. This could indicate that there is a backlog of companies that closed large funding rounds and are waiting to IPO in the near future. Regardless of Talkdesk’s intent to IPO, closing out a $143M Series C round is a testament to investor confidence in the company’s ability to continue being a leader in the industry.

Why this transaction?

The York IE team chose this as our Transaction of the Week (TOW) because Talkdesk’s completion of their $143M Series C round solidifies their position as a leader in the CCaaS market. Recently, organizations have been shifting to a completely remote setting in response to the pandemic; this shift underscores the need for a cloud based solution as companies now heavily rely on their customer support centers. Talkdesk is in a unique position to capitalize on this market trend with their best in class cloud-native CX platform. This latest round will allow Talkdesk to increase R&D spending and continue to service their growing list of top tier clients such as IBM, Trivago & Peloton.Potential For An IPO?

The recent funding round begs the question, when can we expect a Talkdesk IPO? When asked this question, CEO Tiago Paiva declined to comment on any future financing plans but reassured his commitment to the company, “I intend on making Talkdesk the most successful contact center company in the world, and I will do everything it takes to make that happen”. The York IE Team compiled the data of companies that closed large funding rounds since 2010: The graph shows that companies have been raising larger funding rounds over the past decade, reaching a peak in 2018. What this tells us is that despite raising large amounts of capital, more companies are choosing to stay private rather than IPO. Given Talkdesk’s ability to quickly raise capital and perform well in a market with significant tailwinds an IPO would seem likely, our data tells a different story. Taking a deeper look into the graph above we chose to show what percentage of these companies have remained private, IPO’d, closed or been acquired.

The graph shows that companies have been raising larger funding rounds over the past decade, reaching a peak in 2018. What this tells us is that despite raising large amounts of capital, more companies are choosing to stay private rather than IPO. Given Talkdesk’s ability to quickly raise capital and perform well in a market with significant tailwinds an IPO would seem likely, our data tells a different story. Taking a deeper look into the graph above we chose to show what percentage of these companies have remained private, IPO’d, closed or been acquired.

Once again, our data shows that a growing number of companies are choosing to remain private following large funding rounds. This could indicate that there is a backlog of companies that closed large funding rounds and are waiting to IPO in the near future. Regardless of Talkdesk’s intent to IPO, closing out a $143M Series C round is a testament to investor confidence in the company’s ability to continue being a leader in the industry.

Once again, our data shows that a growing number of companies are choosing to remain private following large funding rounds. This could indicate that there is a backlog of companies that closed large funding rounds and are waiting to IPO in the near future. Regardless of Talkdesk’s intent to IPO, closing out a $143M Series C round is a testament to investor confidence in the company’s ability to continue being a leader in the industry.