In this week’s TOW, we look at previous York IE AngelList SaaS Syndicate investment, Onfleet. With San Francisco roots, Onfleet set out in 2015 to design a platform that optimized last-mile delivery for clients across a wide breadth of markets. This latest round, led by Kennet Partners, brings the company’s total capital raised to $18.9M; and allows the company to meet what they call “surging new demand” after seeing their delivery volume double this year.

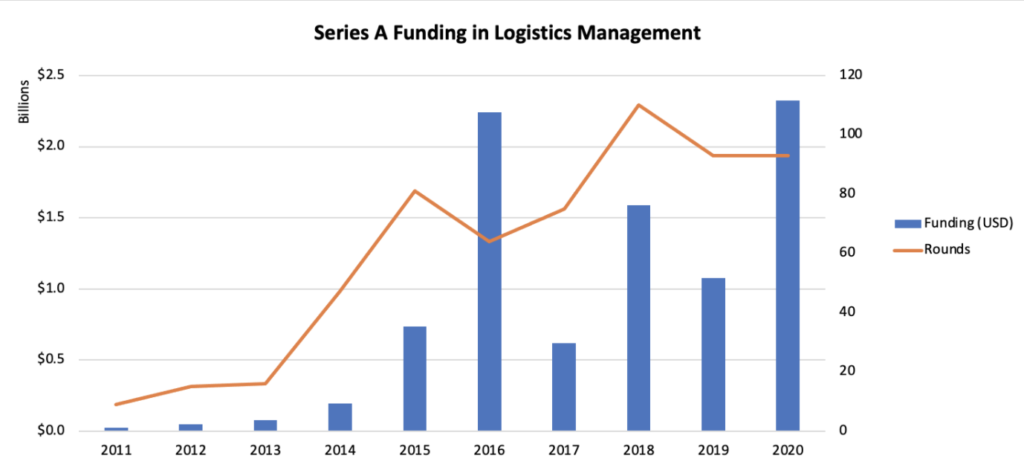

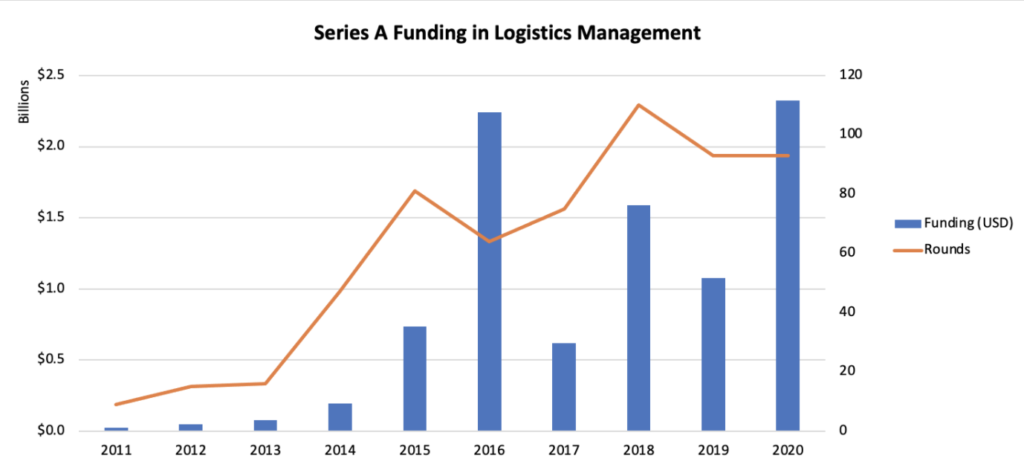

As we can see from the Fuel graphic above, Series A funding for logistics management companies reached a peak of nearly $2.4B in 2020 in under 100 funding rounds. This shows the amount of capital being deployed to solutions, as they look to address the ever growing COVID-19 demand, is growing as the number of companies raising rounds continue to plateau.

As we can see from the Fuel graphic above, Series A funding for logistics management companies reached a peak of nearly $2.4B in 2020 in under 100 funding rounds. This shows the amount of capital being deployed to solutions, as they look to address the ever growing COVID-19 demand, is growing as the number of companies raising rounds continue to plateau.

Why this transaction?

The York IE team chose this as our transaction of the week to discuss how the logistics management market, and companies like Onfleet, are experiencing accelerated growth in 2020. Since 2015, Onfleet has been helping clients track, dispatch and organize their shipments all while incorporating the latest in logistics management software. Even before raising outside money, Onfleet had amassed a client list of over a thousand customers including Kroger & Gap. The York IE team chose this transaction specifically to discuss how Onfleet, like many other companies, has raised outside capital in the wake of the pandemic. With supply chain disruptions and operational constraints becoming commonplace for many distributors, the need for logistics management technologies is obvious. Onfleet isn’t the only company securing outside funding; in fact, San Francisco based DispatchTrack raised a $144M Series A round just this past May. Onfleet CEO, Khaled Naim wrote in his blog, “This funding…will allow us to grow the team more rapidly, enhance our product offerings for both in-house and outsourced delivery models, support our international expansion efforts, and solidify our position as the leader in the last mile delivery technology space”. It is clear that as the global supply chain continues to grow in size and complexity, powerful solutions are needed to meet this growing demand.Disruption Pushing Growth

It is impressive to note the number of companies successfully raising rounds in the midst of a global pandemic. Many of these companies, similar to the ones discussed above, are seeing market growth directly related to the boom in e-commerce being experienced in nearly every industry. With so much strain put on the global supply chain recently, it has been imperative for distributors to upgrade their technology in order to keep up with demand. To show this trend, the York IE team compiled data on Series A rounds in the logistics management industry trailing ten years: As we can see from the Fuel graphic above, Series A funding for logistics management companies reached a peak of nearly $2.4B in 2020 in under 100 funding rounds. This shows the amount of capital being deployed to solutions, as they look to address the ever growing COVID-19 demand, is growing as the number of companies raising rounds continue to plateau.

As we can see from the Fuel graphic above, Series A funding for logistics management companies reached a peak of nearly $2.4B in 2020 in under 100 funding rounds. This shows the amount of capital being deployed to solutions, as they look to address the ever growing COVID-19 demand, is growing as the number of companies raising rounds continue to plateau.