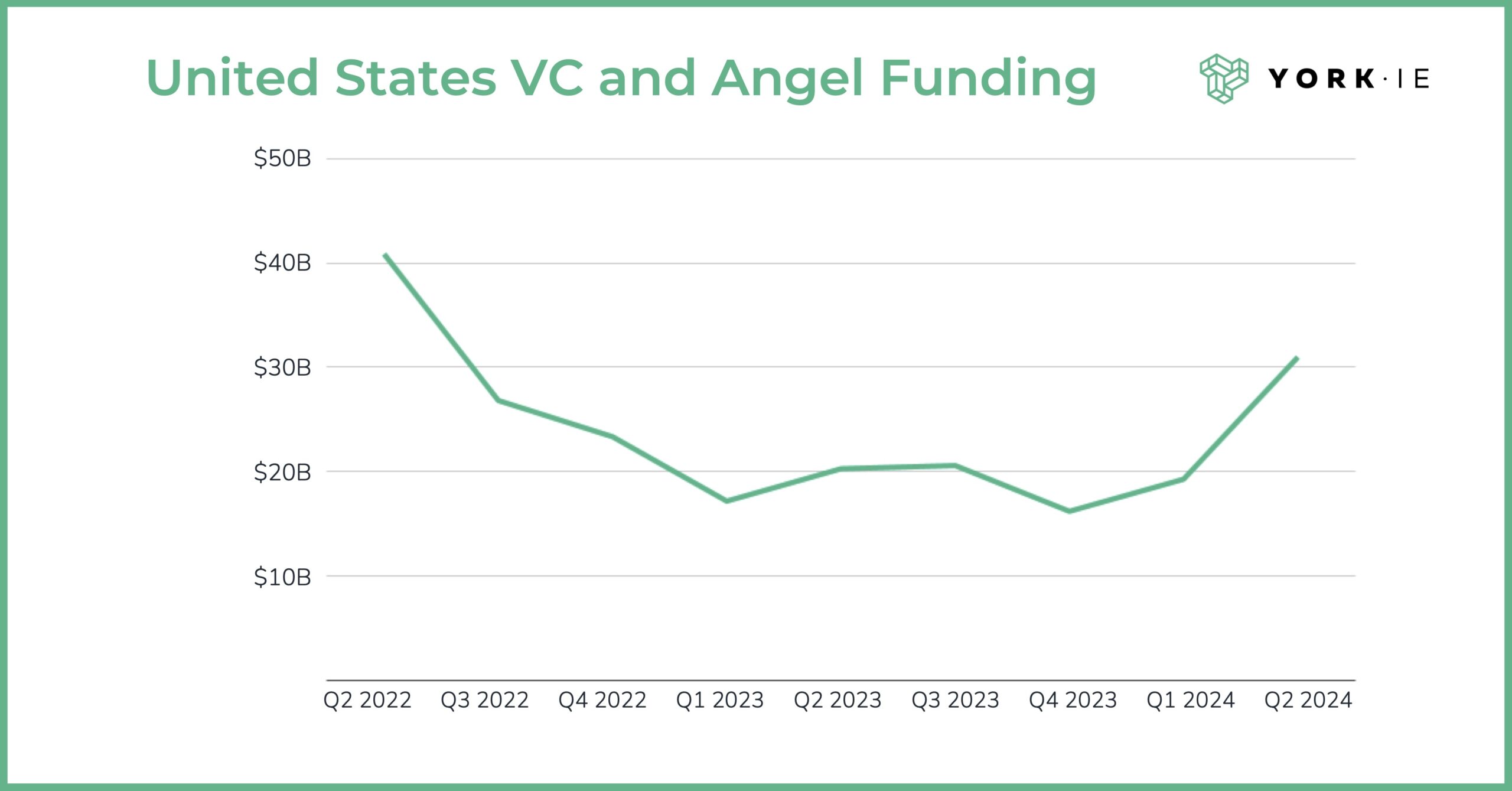

The venture capital market showed significant signs of a rebound in Q2 of 2024.

U.S. companies received nearly $31 billion in angel investments and VC funding — a 61% increase over Q1. That’s the most money raised in a quarter since Q2 of 2022.

“Heading into 2024, we expected to see the markets open back up in the second half of the year,” said Joe Raczka, chief investment officer, York IE. “That timetable is now accelerating, as more startups in both traditional and emerging hubs are securing the capital they need to build successful businesses.”

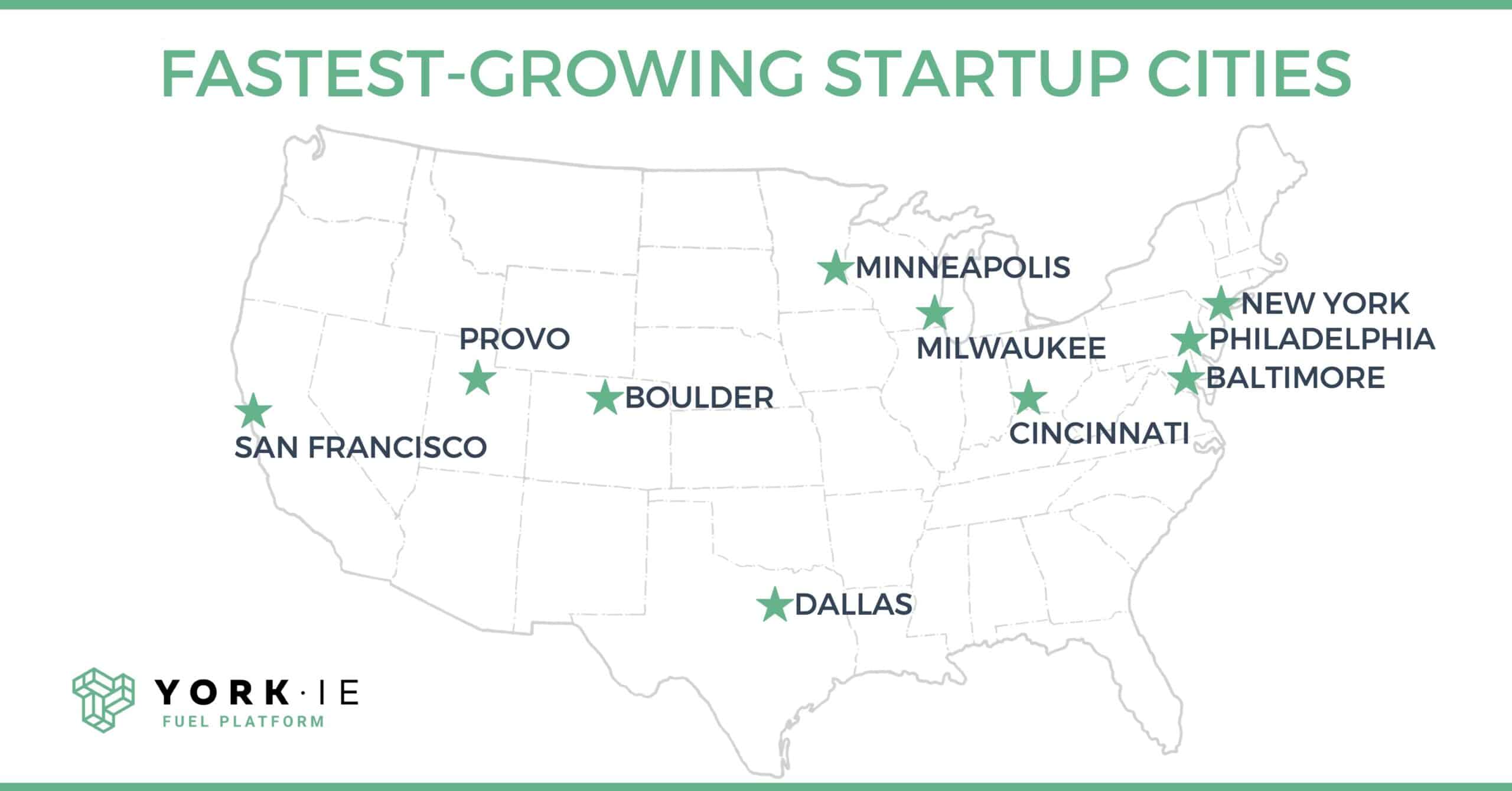

Some traditional startup hubs, including Silicon Valley, New York and Los Angeles, contributed to this growth. But so did many emerging markets across the country, demonstrating that, no matter the economic climate, you can build a successful company anywhere.

The York IE Fastest-Growing Startup Cities report highlights these metro areas where startup funding has increased the most.

Get the Report

Download the full York IE Fastest-Growing Startup Cities report.

CLICK HERE

Fastest-Growing Startup Cities

The report highlights these 10 U.S. metro areas:

- Provo, Utah

- Cincinnati, Ohio

- Baltimore, Maryland

- New York, New York

- Minneapolis, Minnesota

- Boulder, Colorado

- San Francisco, California

- Philadelphia, Pennsylvania

- Milwaukee, Wisconsin

- Dallas, Texas

The full report provides detailed Q2 funding information for each of the 10 cities, including total funds raised, number of rounds and the companies that had the biggest rounds.

Most Venture Capital Investment by City

Additionally, the report ranks the 10 U.S. startup cities with the most venture capital investment:

- San Francisco, California

- San Jose, California

- Boston, Massachusetts

- Los Angeles, California

- New York, New York

- San Diego, California

- Philadelphia, Pennsylvania

- Denver, Colorado

- Dallas, Texas

- Boulder, Colorado