The transition from monolithic to cloud-native applications is well underway, and for good reason. The performance, deployment, agility, and security benefits of breaking down a monolithic app (one massive codebase) into individual services (i.e. microservices) are significant and have been adopted by developers and DevOps teams.

Over the last few years, with the proliferation of distributed, cloud-native applications, and the microservices they are composed of, there has been a major shift in how IT operations/DevOps teams ensure uptime of applications. Monitoring tools such as AppDynamics, New Relic, and even DataDog are no longer sufficient on their own because of the complexity created by numerous microservices interacting with each other. The containers that host microservices are ephemeral in nature, which makes them difficult to monitor, observe, and secure. These cloud-native environments also exhibit complex and disruptive interaction behaviors that make them inherently unstable.

Operations teams require “observability” solutions to complement their monitoring tools so they can have a better understanding of the state of their application. This deeper level of understanding allows them to manage their microservice and application environment, so as to minimize and manage costs in the native cloud, and to be prepared for, and remediate unpredictable failures.

As stated in a recent Security Boulevard article, “Legacy methods based on handling predictable failures often do not work well while monitoring modern distributed applications. Efficient debugging and diagnostics require that the system be observable with a microservice architecture now the de facto standard for web applications.”

Observability is commonly understood as the ability to infer an application’s internal state by observing its output. But in today’s complex and dynamic environments, what matters is no longer a service’s internal state but rather how it interacts with the environment.

While observability tooling has started to provide operations/DevOps teams important additional context, it does not provide arguably the most important thing those teams need—control of the environment. It is valuable for operations/DevOps teams to know there is an issue, it is invaluable for them to be able to remediate that issue in real-time, or better yet, proactively prevent issues from surfacing, ensuring uptime. York IE’s latest investment, Glasnostic, has developed software that will provide operations/DevOps teams with the observability and control they need to assure the stability of their complex environments. Glasnostic was founded by an experienced team after learning firsthand that successful microservice architectures are run, not built.

York IE is always excited to partner with founding teams that possess a technical edge on the market. We believe Glasnostic, led by CEO and Co-founder, Tobias Kunze has such an edge. Tobias is a thought leader in cloud-native technologies, famous for being the brains behind the technology that became Red Hat OpenShift, a family of containerization software products developed by Red Hat. Tobias developed the technology underlying OpenShift as the Co-founder and CTO of Makara, which was acquired by Red Hat in 2010. Tobias stayed on with Red Hat through 2014 as a Senior Principal Software Engineer helping evolve Makara into OpenShift. Leading Glasnostic’s development efforts is CTO & Co-founder, Marcus Schiesser. Marcus has previously been a technical/engineering leader at companies including Kosmos Systems AG, DB Systel GmbH, and GEOwidget GmbH. Helping Tobias drive go-to-market strategy is Chief Commercial Officer, Danial Faizullabhoy. Danial has served as the CEO of Cypherpath Inc., a software-defined infrastructure solution, and CEO and President of BroadLogic Network Technologies, which was acquired by Broadcom. The combination of product/engineering experience and GTM acumen represented by this leadership group gives York IE a high level of confidence that Glasnostic can be a commercially successful innovation in the complex DevOps market.

An oft-quoted statistic from Gartner is that the cost of application/network downtime is $5,600 per minute. Today’s rapidly evolving microservice environments are prone to disruptive interaction patterns that can result in business/application downtime resulting in lost revenue and costs to remediate- not to mention the cost of trying to avoid such events in the first place.

Glasnostic’s software can control these unpredictable behaviors, in real-time, before they result in downtime. As previously mentioned, monitoring and observability are not enough to ensure uptime of modern, cloud-native environments. Beyond the fact that they can be expensive and staff-intensive to manage, they are ineffective against unpredictable disruptions. Even when monitoring or observability tooling is able to identify an issue, there is typically a slow, meticulous, and manual process required to remediate it.

Glasnostic’s software provides both observability and control that makes it easier and cheaper to manage disruptions and maintain uptime. Operations/DevOps teams using Glasnostic real-time control solution will be able to lower their Mean Time To Remediation (MTTR) to within a minute due to the reduction in time of figuring out what the root cause of an issue is. This means that instead of a day-long outage, everything will be fixed within a minute. This massively reduces operational risk and allows developers and operations teams to run faster and smoother.

An additional point of ROI for customers is the decrease in Mean Time To Value (MTTV) that Glasnostic provides. Customers will not have to deploy applications to staging environments prior to launching in production. They are able to deploy directly to production because now with Glasnostic they have control over how things work and applications/microservices interact. It further simplifies the developer’s job by allowing them to focus on individual services as capabilities and run them.

In other words, Glasnostic can serve as a control plane for operators. Monitoring systems and detecting failures is worth little without the ability to remediate effectively and in time. Glasnostic’s platform for observability and control enables operations, Site Reliability Engineering (SRE) and security teams to respond to complex, disruptive behaviors effectively, with powerful and predictable control primitives, in real-time without any agents and without configuration files/YAML. Glasnostic’s platform for observability and control is an agentless, non-invasive and infrastructure-agnostic operations solution that works via a distributed fleet of virtual service routers that turn existing networks into an active, application-aware fabric that lets the platform for observability and control detect and remediate disruptive behaviors, in real-time. The platform for observability and control can be consumed in the cloud or installed on-premises. Service routers deploy as virtual appliances in physical or virtual machine environments, or as a DaemonSet in Kubernetes. Because Glasnostic inserts cleanly into the network and requires no agents and no modifications to code or deployment artifacts, it works with every stack and in any environment, without affecting developers or processes. For environments running Istio, Glasnostic provides an Istio-Proxy (Envoy) adapter. After being deployed in a network Glasnostic will continuously deepen its understanding of the behaviors of the interactions between services and/or applications. This will enable operations and DevOps teams to become proactive in maintaining uptime.

The company’s leadership team has a grander vision of eventually making Glasnostic a turn-key fully managed service. This means that their team would be responsible for managing the solution for customers and maintaining uptime of the customer’s applications. This is counter to the current paradigm that monitoring and observability reflect, where the customer uses their tools to be alerted on potential issues and then has to remediate the issue themselves. Removing the need for operations and DevOps teams to continuously monitor or observe their applications will significantly lower the total cost of ownership (TCO) for the customer’s applications and environment. This aligns with a broader trend in the IT industry where larger providers are taking on more of the operations responsibility from the customer. This trend was started by AWS and cloud providers over a decade ago and is further exemplified by the rise of serverless computing.

Determining the market opportunity for Glasnostic was a somewhat complex problem to solve due to the fact that there is no other solution in the IT operations or monitoring/observability markets that is comparable. Major players in the space that focus on monitoring and observability include Splunk (Market Cap= ~$25B), New Relic (Market Cap=~$3.85B), and Datadog (Market Cap=~$30B). However, none of these vendors provide the “control” aspect that makes Glasnostic so unique. Our team found Datadog’s S-1 from 2019 to be a valuable source to base our analysis on. Datadog stated in their S-1;

“We believe that our platform currently addresses a significant portion of the IT Operations Management market. According to Gartner, the IT Operations Management market represents a $37 billion opportunity in 2023. We believe a large portion of this spend is for legacy on-premise and private cloud environments, but does not fully include the opportunity in modern multi-cloud and hybrid cloud environments. Our platform is designed to address both legacy and modern environments. We estimate our current market opportunity to be approximately $35 billion.”

While Glasnostic is not as feature-rich as Datadog at this point, this statement clearly shows that there is belief in a large market opportunity for IT Operations Management and monitoring/observability solutions. In our diligence process, Glasnostic also showed that the LTM revenue for the four big public application performance monitoring (APM) players (Datadog, New Relic, AppDynamics, and Dynatrace) was $3.6 billion. Another data point we considered was from the press on the announcement of Splunk’s recent acquisition of Flowmill (Splunk’s fifth acquisition in the past two years to grow its presence in the cloud monitoring market or observability market), a network performance monitoring (NPM) startup. In this announcement, a $12 billion market size was attached to the online monitoring market. While all of these market sizes are imperfect for this particular scenario, largely due to the Glasnostic solution falling under multiple market categories, they gave York IE the conviction that Glasnostic has a large market opportunity in front of them.

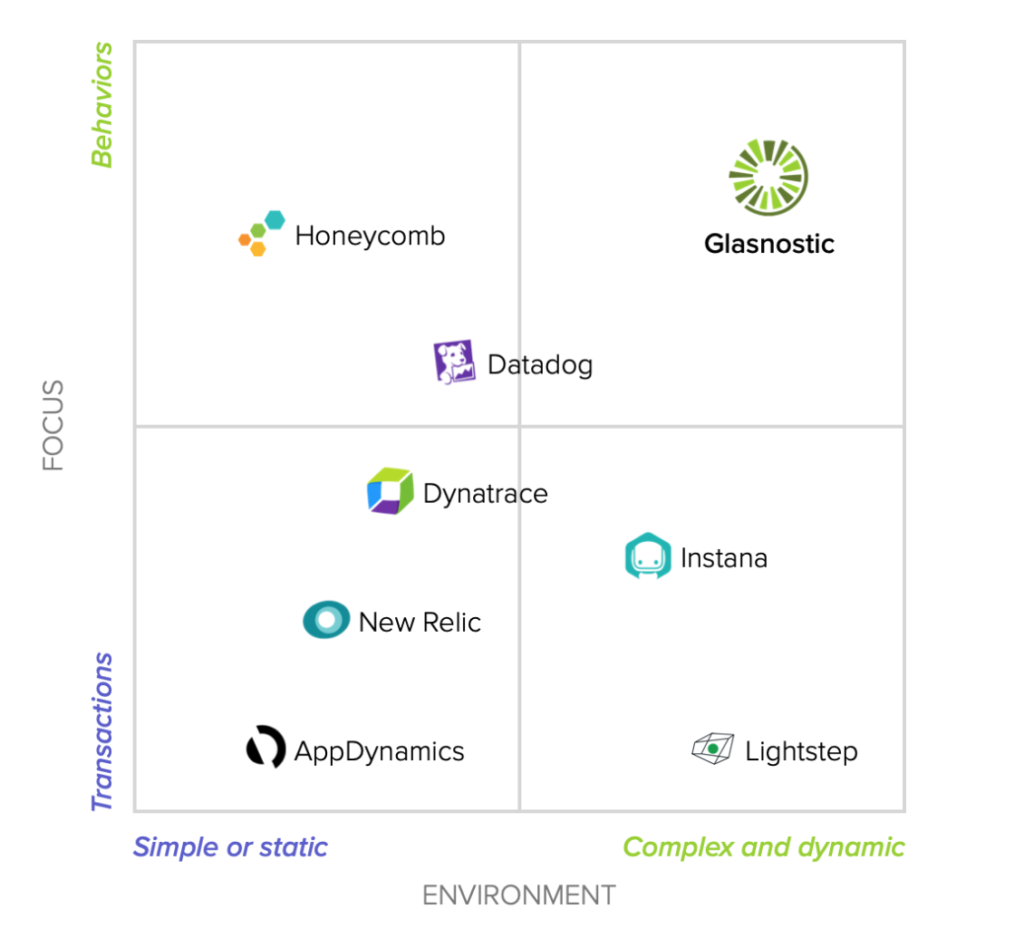

At a high level, the thing to remember is that of all the monitoring and observability solutions in the market, Glasnostic is the only solution that provides control. By focusing on control and management of the disruptive behaviors of today’s complex and dynamic environments, Glasnostic ensures optimum performance of these networks and minimizes cost and failures. Other vendors in the ecosystem include the public companies listed above along with startups such as, Honeycomb, Instana (just acquired by IBM), Pixie Labs (just acquired by New Relic), and Lightstep. Most of these vendors are analyzing the “transactions” between applications or microservices, while Glasnostic’s focus on the behaviors of the interactions provides much needed, and valuable, context. Glasnostic is purpose-built for the complex and dynamic environments of cloud native applications. Most competitors are best suited for legacy, simple, and static application environments.

The York IE team believes that it is beneficial to elaborate on the competitive dynamics between Glasnostic and the larger competitors in the market. It is important to understand that in the short term, there will be customers with monitoring needs Glasnostic can’t serve. For example, if a potential customer’s needs are 80% monitoring and 20% control, they will most likely choose Datadog or Splunk, or another incumbent to start. This is because that incumbent will provide them with a majority of what they need. Most companies though, will already have a lot of monitoring in their network, most likely from a variety of tools, so the monitoring slice will be much smaller. In these situations, Glasnostic’s opportunity will be determined based on their integrations with the monitoring solutions already in the network. By complementing existing tools, and providing control on top of the data and alerts they are sending to customers, Glasnostic will be able to penetrate their market and show its value.

Since Glasnostic was founded in 2016, most of the team’s time and resources have been spent together with design partners developing the technology and platform. Now that the product is proven and production-ready, go-to-market is a primary focus. The core value prop that Glasnostic’s GTM strategy will be based on is that it simplifies and eases the operations half of DevOps. York IE believes this value prop should enable a bottom-up GTM motion that is driven from the love users have for the product and results in a community of “operators” that promote the product. A great example of this strategy is Datadog and how they scaled. Providing a great product that resulted in a community of adherents led to significant net new customer adoption as well as expansion within enterprises. This GTM model will leverage customer success, content marketing (drumbeat marketing, thought leadership, earned content, influencers in the market, etc), and inside sales to land and expand within operations and DevOps teams. Glasnostic also has the ability to be used for security purposes, providing for significant expansion potential within an enterprise beyond the Operations/DevOps team. However, as is the case with any early-stage startup, driving user adoption and fondness takes time. Working closely with initial customers will continue to be extremely important to ensure the product continues to mature in line with their needs and expectations.

Although Glasnostic is well-positioned for a product-led GTM model, the leadership team has been able to drive some impressive early traction with Fortune 500 companies via top-down sales model, leveraging their network and pedigree in the market. Recently, Glasnostic landed a large European IT equipment and services provider as a customer. The company is also deeply engaged with multinational telecommunications corporations, government entities, and IoT consultancies.

From a market channel perspective, Glasnostic launched in the AWS marketplace in November as a partner to the cloud provider. The company will look to leverage this relationship to help drive customer engagement and adoption. In Europe, Glasnostic is working with another innovative cloud provider as a channel partner.

The York IE team, having spent many years in the infrastructure and operations space, is truly blown away by the innovative platform developed by the Glasnostic team. We are extremely excited to partner with Tobias and his team, and are looking forward to helping Glasnostic achieve its awesome potential.