One day I’ll be CEO of my own company. For years I’d contemplate the type of business I would build and run. I enjoyed my career rise playing complement to technical founder/CEOs, but knew my destiny was to run my own business when the time was right. I also knew that the technical founder/CEO would still need me and I could scale my reach and impact. I didn’t want to give up that competitive advantage.

As I grew in both my angel investing and SaaS executive career, I wrestled deeply with the notion I would need to make a binary this way or that way choice. I loved both, so why would I need to pick one career track? It felt like a divergent decision that would leave me feeling empty and unsatisfied and asking “what if?” I felt like I also had the unique combination of ambition, skillset, personality, relationships, partners and drive to shake it up and invent my own hybrid path. If anyone could do it, it was me.

One respected industry friend even said to me, “you’ll learn investing is way more boring than operations” and “you would be such an amazing SaaS founder though” and “we have so many more companies to build.” This was a casual 10 minute text trail when I explained my vision to do both. It wasn’t that he didn’t get it. It was more that the past for him had been one or the other and doing both at once was a heavy lift.

The idea that you could be both and do both was one that most traditional ventures capitalists AND traditional operators challenged me on. What a thrilling challenge to undertake. We’re early innings and it’s proving to FUEL me. The value this approach drives to entrepreneurs we back and co-investors with us is immense.

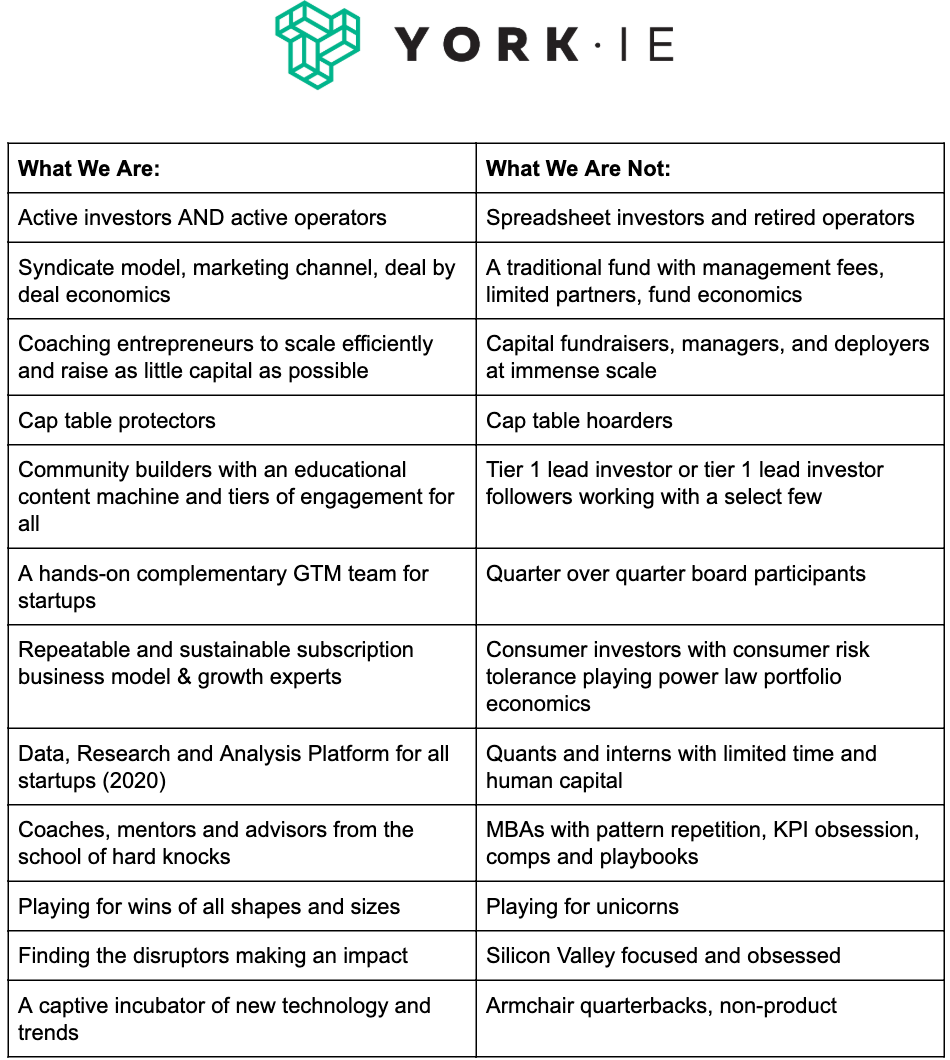

For the sake of clarity, here are a few things my startup, York IE, is and then a few things we aren’t.

| What We Are: | What We Are Not: |

| Active investors AND active operators | Spreadsheet investors and retired operators |

| Syndicate model, marketing channel, deal by deal economics | A traditional fund with management fees, limited partners, fund economics |

| Coaching entrepreneurs to scale efficiently and raise as little capital as possible | Capital fundraisers, managers, and deployers at immense scale |

| Cap table protectors | Cap table hoarders |

| Community builders with an educational content machine and tiers of engagement for all | Tier 1 lead investor or tier 1 lead investor followers working with a select few |

| A hands-on complementary GTM team for startups | Quarter over quarter board participants |

| Repeatable and sustainable subscription business model & growth experts | Consumer investors with consumer risk tolerance playing power law portfolio economics |

| Data, Research and Analysis Platform for all startups (2020) | Quants and interns with limited time and human capital |

| Coaches, mentors and advisors from the school of hard knocks | MBAs with pattern repetition, KPI obsession, comps and playbooks |

| Playing for wins of all shapes and sizes | Playing for unicorns |

| Finding the disruptors making an impact | Silicon Valley focused and obsessed |

| A captive incubator of new technology and trends | Armchair quarterbacks, non-product |

Some of our core beliefs that anchor us:

- Our customer is the entrepreneur and the vast majority of our time needs to be spent with them

- We can make more impact across a portfolio as co-founders, operators, board members, advisors, investors and operators than by doing one SaaS business again

- We must remain active operators and stay relevant and sharp to latest business models and technologies

- To scale ourselves, we need to invest in our team, infrastructure, tools and automation

- We are data and research driven with an instinctive touch who must be the most prepared in the room

- We operate like early stage growth PE, not venture capital

- A $15M, $25M, $50M exit should still be celebrated

- They say 1 in 10 startups make it. Let’s shoot to flip those ratios entirely

- Be loyal and always play the long game

There is a lot left to accomplish and the mountain to conquer is a steep one, but we’ve got a vision, execution plan and team I wouldn’t bet against. Stay tuned as our FUEL becomes your FUEL too. We’ve learned time and time again that where there is a will, there is a way.