On Monday, Juniper Networks announced a $450M acquisition of the Boston-based company, 128 Technology; this latest addition to Juniper’s portfolio increases the company’s exposure to the Software Defined Wide-Area-Network (SD-WAN) market. This marks the second of such deals that Juniper Networks has completed this year, in March the company announced their $405M acquisition of longtime partner, Mist Systems, a WLAN vendor. With their two latest acquisitions, Juniper Networks is now well-positioned within the SD-WAN market and has exposure to its growing trend towards AI.

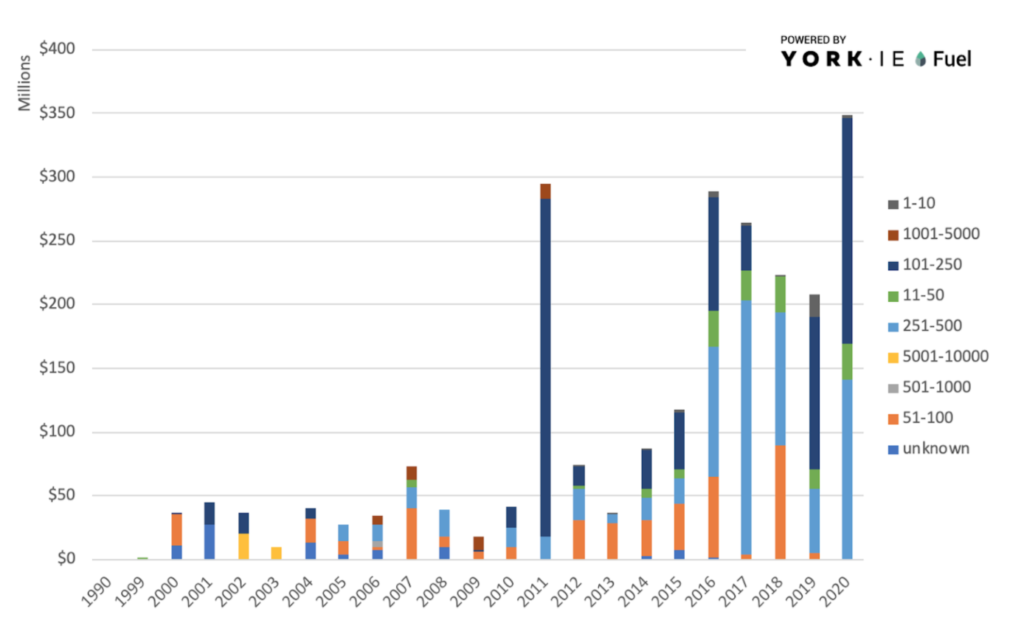

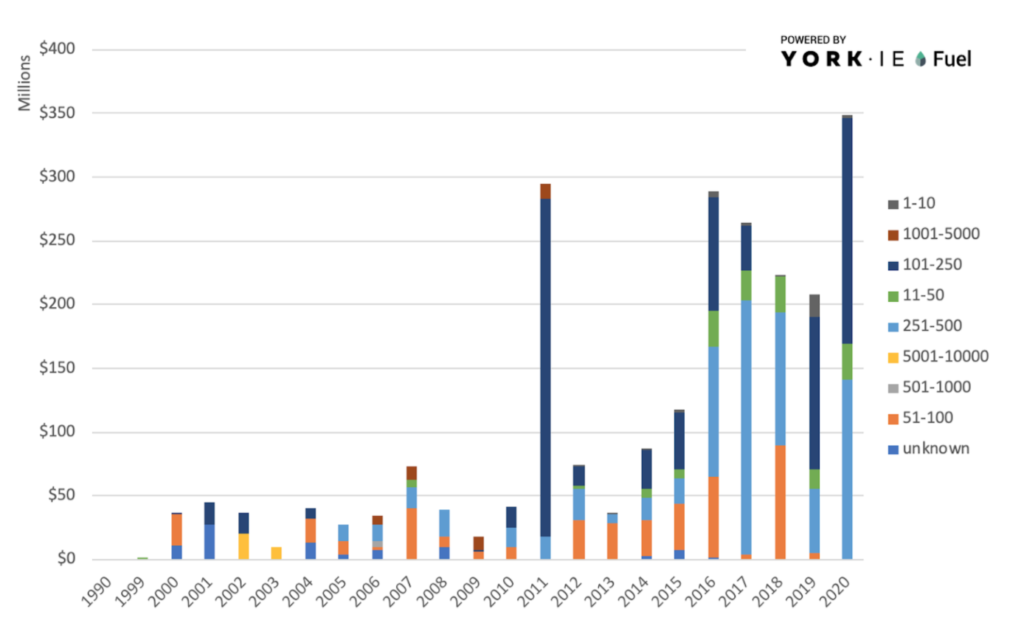

As the graphic above shows, small to mid-sized companies represent the majority of acquisitions in the market since nearly 2010. The York IE team wanted to dig into this further and compiled data related to funding and acquisitions across the SD-WAN market:

As the graphic above shows, small to mid-sized companies represent the majority of acquisitions in the market since nearly 2010. The York IE team wanted to dig into this further and compiled data related to funding and acquisitions across the SD-WAN market:

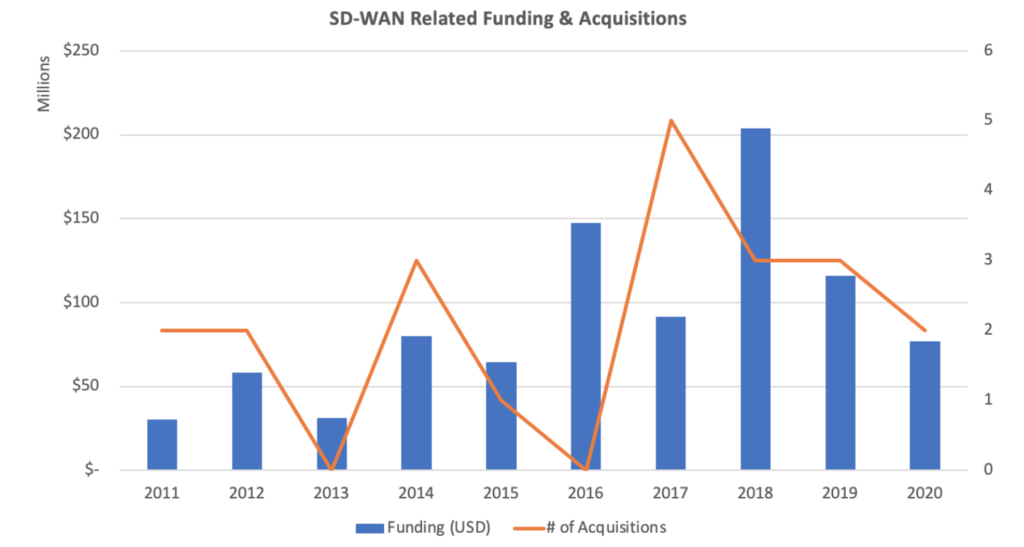

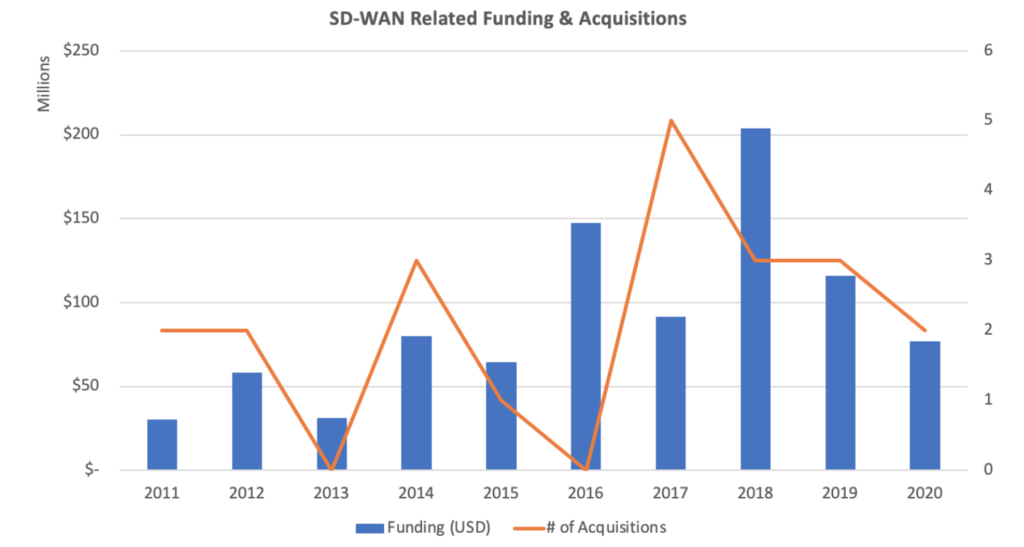

What we found was that funding for companies continued to grow at a staggered pace but the number of acquisitions clearly does not follow the same linear trend. One could argue that given the high number of acquisitions in 2017, the market for SD-WAN solutions has already established itself and companies are now looking for ways to differentiate themselves against competitors.

What we found was that funding for companies continued to grow at a staggered pace but the number of acquisitions clearly does not follow the same linear trend. One could argue that given the high number of acquisitions in 2017, the market for SD-WAN solutions has already established itself and companies are now looking for ways to differentiate themselves against competitors.

Why this transaction?

The York IE team chose this as our transaction of the week to explore one of the many industries adopting AI. Since making the switch from WAN to SD-WAN, many organizations have experienced the benefits of adopting cloud interfaces as opposed to their proprietary legacy equipment. As SD-WAN adoption continues to grow, companies like Juniper Networks are looking to solve some of the challenges adopters are facing like threats in security and worries over network management. With their latest acquisitions, Juniper Networks has built itself a wide breadth of AI-enabled SD-WAN technologies and looks to continue their success. By implementing machine learning into their SD-WAN solution, Juniper is able to offer their users reduced costs related to bandwidth utilization, AI-driven IT operations and much more. With AI, network security can become fully automated allowing administrators to spend more time on critical operations management; this all comes as employees continue to work from home, further straining their organization’s network. The York IE team believes, with their two latest acquisitions, Juniper Networks has positioned itself well against the broader market and by leveraging their AI-driven portfolio, will continue to see success.SD-WAN Becomes Mainstream

In a previous TOW blog, we discussed the trend of companies opting to “buy-into” the SD-WAN market rather than building proprietary solutions. We shared with you this graphic, which displays SD-WAN related acquisitions distinguished by company size: As the graphic above shows, small to mid-sized companies represent the majority of acquisitions in the market since nearly 2010. The York IE team wanted to dig into this further and compiled data related to funding and acquisitions across the SD-WAN market:

As the graphic above shows, small to mid-sized companies represent the majority of acquisitions in the market since nearly 2010. The York IE team wanted to dig into this further and compiled data related to funding and acquisitions across the SD-WAN market:

What we found was that funding for companies continued to grow at a staggered pace but the number of acquisitions clearly does not follow the same linear trend. One could argue that given the high number of acquisitions in 2017, the market for SD-WAN solutions has already established itself and companies are now looking for ways to differentiate themselves against competitors.

What we found was that funding for companies continued to grow at a staggered pace but the number of acquisitions clearly does not follow the same linear trend. One could argue that given the high number of acquisitions in 2017, the market for SD-WAN solutions has already established itself and companies are now looking for ways to differentiate themselves against competitors.