PagerDuty, a leader in digital operations, announced this week that they have entered an agreement to acquire Rundeck, a company providing scaled automation for DevOps teams. Per the deal, Rundeck will receive $100M, 60% of which will be in cash and the remaining 40% in PagerDuty common stock. With the acquisition of Rundeck, PagerDuty says they will be able to offer the most robust real-time incident response platform on the market.

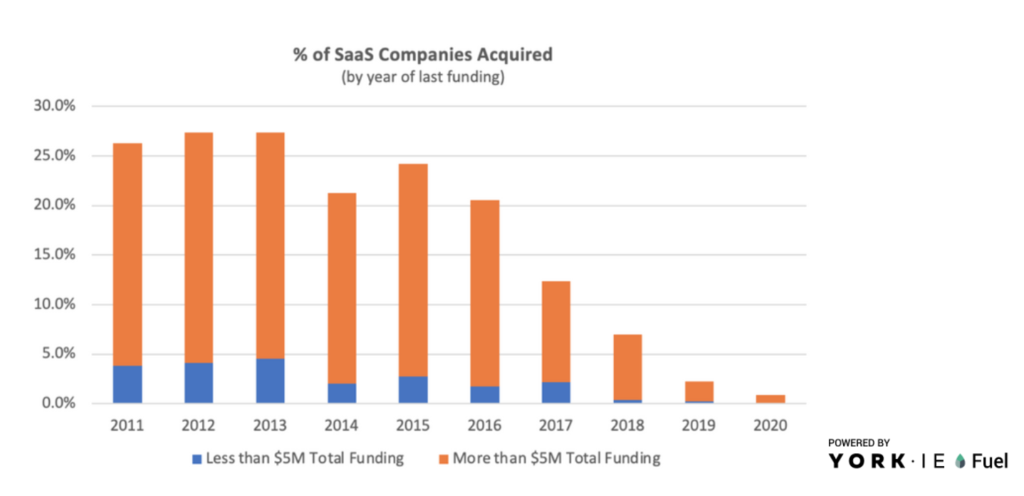

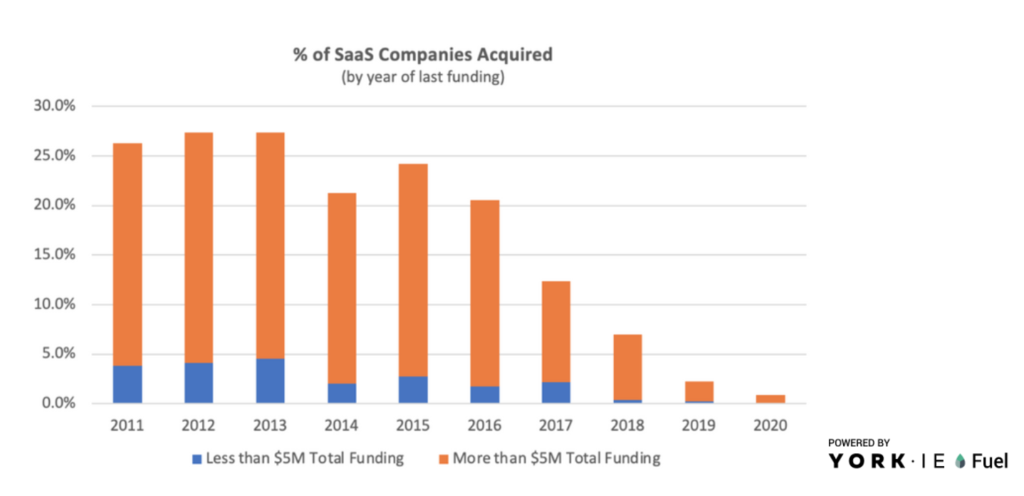

As you can see from the graph above, SaaS companies with <$5M in total funding represent a severe minority of all acquisitions. Pagerduty’s $100M acquisition of Rundeck, a company with only $3M in total funding, emphasises the strategic value of this deal for both parties, and almost certainly means a big win for Rundeck’s founders, employees, and investors. As companies expand their work from home policies more people are online; DevOps teams who once played a supporting role are now leaders & essential to business success.

As you can see from the graph above, SaaS companies with <$5M in total funding represent a severe minority of all acquisitions. Pagerduty’s $100M acquisition of Rundeck, a company with only $3M in total funding, emphasises the strategic value of this deal for both parties, and almost certainly means a big win for Rundeck’s founders, employees, and investors. As companies expand their work from home policies more people are online; DevOps teams who once played a supporting role are now leaders & essential to business success.

Why this transaction?

The York IE team chose this as our transaction of the week to showcase another SaaS company that is expanding it’s portfolio through strategic M&A. For PagerDuty, this acquisition accelerates their growth in Enterprise DevOps and gives them access to Rundeck’s open-source community of over 60,000 active users. Since the acquisition, PagerDuty has released their new customer service solution that allows users to work directly with Development and IT teams. By implementing Rundeck’s automated machine-centric workflows – or runbooks – PagerDuty has created a solution that can automate what they call “the entire incident response lifecycle”. For customers, this means PagerDuty is able to resolve & expedite incidents while protecting customer experience.Expanding Portfolios to Accelerate Account Growth

For PagerDuty, and other SaaS companies engaging in strategic M&A, this type of acquisition helps them increase their potential account size. As companies expand their platforms they are able to charge additional fees for the added features, leading to account growth which translates to a boost in Net Revenue Retention. NRR is calculated as a company’s total revenue from a particular cohort, minus any revenue churn, plus revenue from expansions/up-sells; at York IE we believe that any SaaS company with strong NRR stands out amongst the rest because it means the company is able to grow based solely on expanding the account size of current customers. In light of the PagerDuty acquisition the York IE team decided to compile data on SaaS company acquisitions, based on funding, since 2011: As you can see from the graph above, SaaS companies with <$5M in total funding represent a severe minority of all acquisitions. Pagerduty’s $100M acquisition of Rundeck, a company with only $3M in total funding, emphasises the strategic value of this deal for both parties, and almost certainly means a big win for Rundeck’s founders, employees, and investors. As companies expand their work from home policies more people are online; DevOps teams who once played a supporting role are now leaders & essential to business success.

As you can see from the graph above, SaaS companies with <$5M in total funding represent a severe minority of all acquisitions. Pagerduty’s $100M acquisition of Rundeck, a company with only $3M in total funding, emphasises the strategic value of this deal for both parties, and almost certainly means a big win for Rundeck’s founders, employees, and investors. As companies expand their work from home policies more people are online; DevOps teams who once played a supporting role are now leaders & essential to business success.