Deal sourcing is the key to building a diversified and ultimately successful investment portfolio.

Investing in early-stage companies is fraught with risk. To minimize this risk, you need to continuously make a variety of investments over a long period of time. And you can only make continuous investments if you have continuous deal flow.

What is Deal Sourcing?

Deal sourcing is a blanket term investors use to cover all the methods they rely on to find companies to invest in.

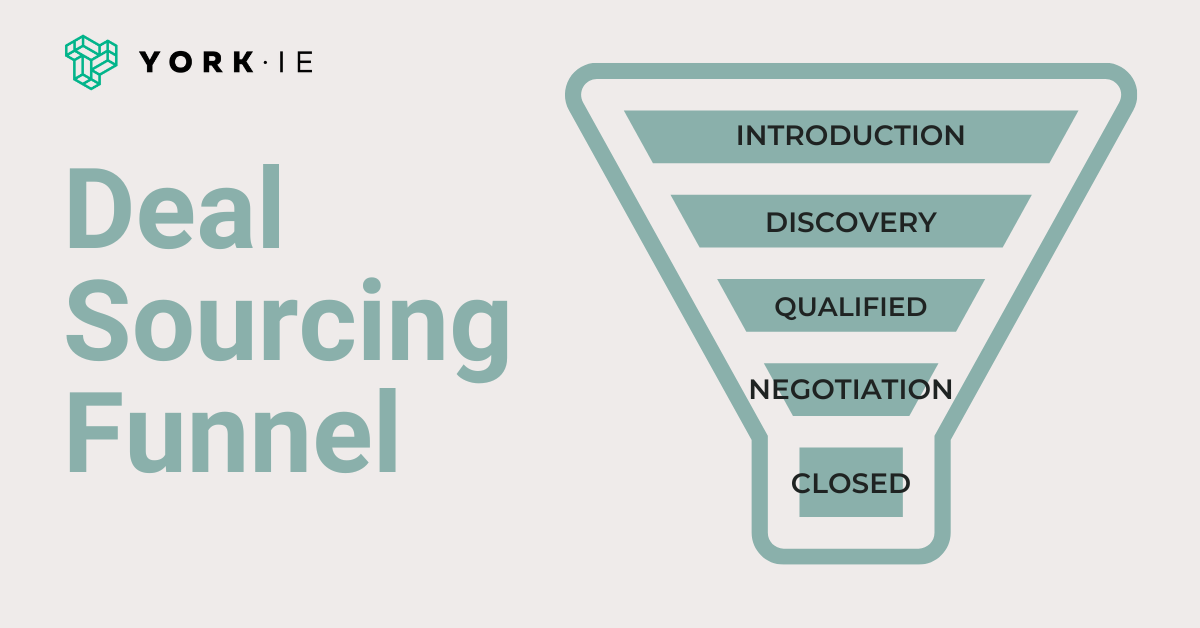

Think of deal sourcing like a sales or marketing funnel. Good investors will try to cast a wide net of potential investments — the top of the funnel — and then narrow them down through a series of qualifying steps until they identify the companies they are committed to investing in.

Our deal sourcing funnel looks something like this:

- Introduction

- Discovery

- Qualified

- Negotiation

- Closed

Here’s how we approach investment deal sourcing to ensure we always have a healthy pipeline — and how you can, too:

- Develop a helpful reputation.

- Build your brand.

- Seek partners.

- Get experience.

1. Develop a Helpful Reputation

York IE is a strategic growth company that also invests. We don’t just write a check. We are an active investor at a stage where you do not find many active investors — especially ones with as much breadth of resources as we have. We have the ability to act as an extension of our startups’ operating teams through our operating platform, which help with everything from sales and marketing to finance and product development.

There is a major gap for early-stage startups looking for smart money — not just a passive check, but the help they need to grow sustainably. Founders talk to other founders, and if you can develop a reputation as someone who provides that help, you’ll see massive results in deal sourcing.

2. Build Your Brand

We practice what we preach when it comes to drumbeat marketing. Our team consistently pushes out thought leadership and engaging content across many different channels, and our startup blog is ranked 16th in the world by FeedSpot.

Because of these efforts, we have thousands of website views each month, and multiple investment-seeking companies reach out to us cold because they read something we published. Building our brand directly leads to investment deal sourcing.

3. Seek Partners

Our top-tier investment partners contribute significantly to our deal sourcing. They include current and former executives and partners of some of the largest financial, venture capital and technology firms in the world.

These partners are highly engaged and constantly sharing deal flow with us. Why? Because we have always prioritized building the strongest network possible — even before we founded York IE.

By being active, engaged and helpful within the startup ecosystem, you will command respect and admiration — and create demand among founders who want to work with you.

4. Get Experience

All of the above is possible because we have experienced the entire process of building, raising money for and ultimately successfully exiting a startup firsthand.

The founding team of York IE played an instrumental role in building and scaling Dyn to its eventual acquisition by Oracle. And at Dyn, we were early in understanding the benefits of brand, community, a bottoms-up go-to-market strategy, content marketing, usage-based pricing and product-led growth, which is why so many people still look to us for assistance today.

No investor wants to spend their days chasing deals or sending cold emails to fill their pipeline. Become someone that founders and other investors want to work with, and you’ll make deal sourcing a lot easier on yourself.