Seed funding for startups is a great way to help you scale sustainably.

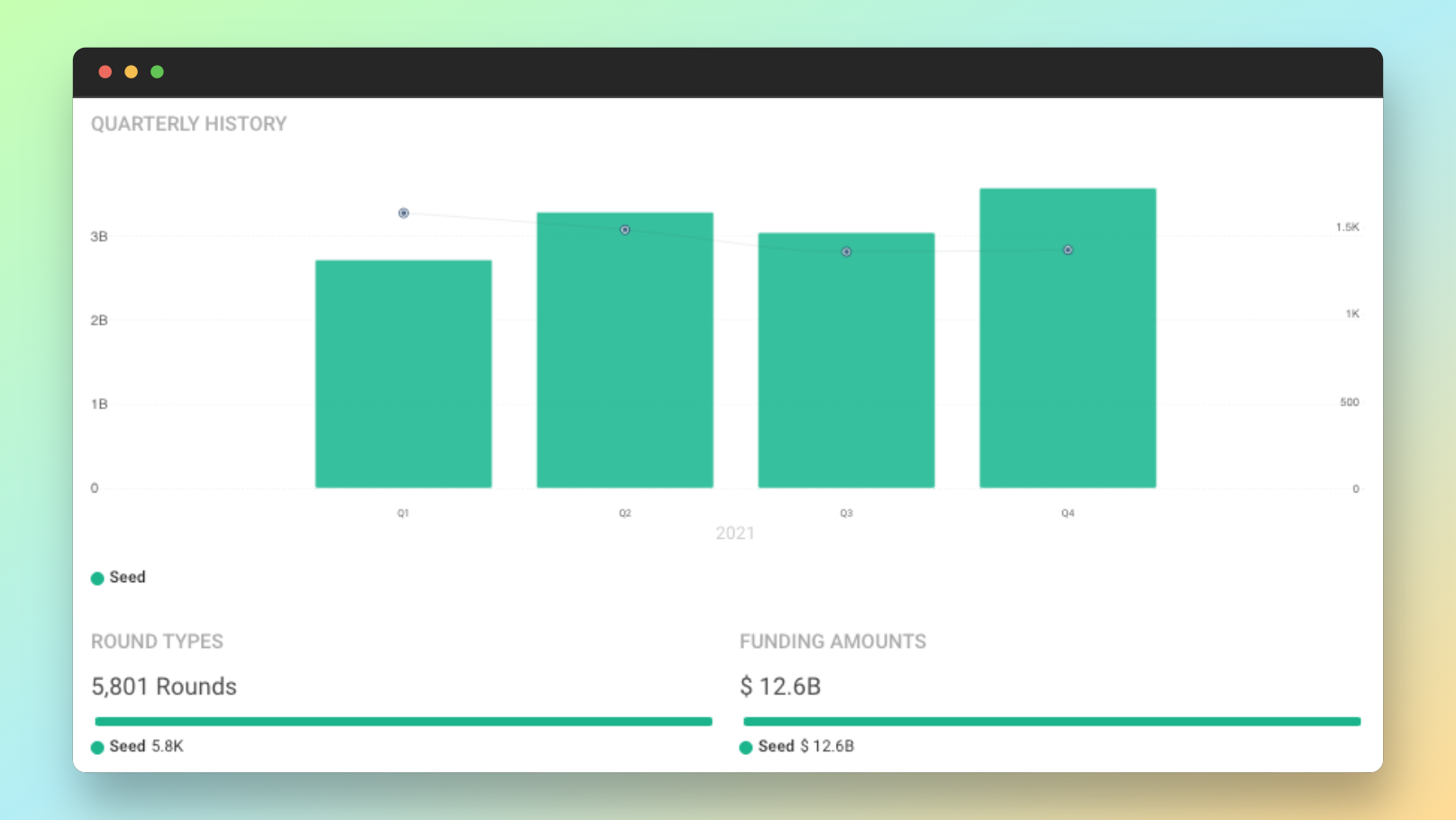

Unless you’re a bootstrapping outlier, your early-stage company will likely need an injection of outside capital. U.S. startups raised $12.6 billion in Seed money over 5,801 rounds in 2021, for an average Seed round size of $2.17 million, according to York IE Fuel.

In this guide, you’ll learn:

- What is Seed funding?

- How do startups get Seed funding?

- Pros and cons of Seed fundraising

- Do you have to pay back Seed funding?

- How to secure Seed funding for startups

What Is Seed Funding?

Seed funding is capital that helps early-stage startups make strategic new hires, refine their go-to-market (GTM) strategy and solidify product market fit.

It’s called Seed because you have a basic business in place (the “seed”), and you just need some help to accelerate your growth. For the team at York IE, the Seed stage is distinct from the earlier Pre-Seed stage, which we consider to generally encompass businesses with small teams, no revenue and an idea or prototype that hasn’t truly been tested in the market.

At the Seed stage, you might have a leadership team, a product or service you’re offering to the market and — if things are going well — some paying customers. Even if you’re pulling in relatively impressive revenue, it might not be enough cash to fund your next move. Perhaps you want to hire a new sales team or some senior developers, or you’re ready to market your offering to a new vertical. Seed investors provide the necessary capital, expertise and connections to help make that happen.

As an investor, I’ve worked with dozens of companies on Seed rounds. Generally speaking, companies successfully secure funding when they’ve built a strong network, own their investor research and persevere through rejection.

How Do Startups Get Seed Funding?

Startups get seed funding from investors by demonstrating that they have:

- a product

- founder market fit

- early signs of product market fit

- customers and/or revenue

In simple terms, there needs to be real evidence that a business is being built, even if you’re still sorting things out.

Product

You’re past the genesis stage of business growth and you have something tangible. It can be a minimum viable product, but some development work is already done.

Founder Market Fit

Why are you and your leadership team the right people to solve the problem? Consider your experience and credibility within your market.

Early Signs of Product Market Fit

You should have a strong idea of who your customer is. You’re looking for repeatable use cases for your product or service.

Customers/Revenue

Not entirely necessary, but helpful. Best-case scenario, you’ve got a crew of customers and are pulling in $100,000 to $200,000 in annual recurring revenue. If you’re not there, you’ll ideally have some customers, even if they’re early design partners.

When a Seed investor joins your team, it’s a sign that they really believe in you and your vision. They’re an early partner that will be along for a (hopefully) long journey.

Get Seed Funding for Your Startup

At York IE, your success is our success.

Want to work with investors who care about growth, not vanity metrics?

PITCH US

Pros and Cons of Seed Fundraising

Seed funding for startups is necessary in most — but not all — cases. Like any decision for your company, there are positives and negatives to taking Seed capital:

Pros of Seed Funding

Seed investors are more than just a source of capital. They’re active collaborators who will form a strong connection with your leadership team and develop a deep understanding of your product, market and customers. That type of support — especially from people who specialize in growing companies — is invaluable.

As a Seed-stage company, you’re going to face a lot of uncertainty. Investors are there to guide you through the early stages of maturation. They might connect you to potential CTO or CMO candidates, introduce you to other investors for later rounds or use their connections to find new customer bases.

Cons of Seed Funding

Anytime you’re taking outside capital, you’re selling a piece of your business. You’re effectively gaining a new boss — someone with a board seat and expectations for you.

If you have a really cost-effective GTM strategy and are growing revenue without needing to hire new talent, then you might choose not to undertake a Seed round. You’ll maintain leverage and optionality for future decisions.

There are a handful of hundred-million-dollar companies that have avoided or at least delayed taking on outside capital (think: Mailchimp, Calendly, Dyn). I want to stress that they’re outliers, but it is possible.

Do You Have to Pay Back Seed Funding?

You do not have to pay back Seed funding as you would a loan. Venture capital is a sum of money you receive in exchange for an ownership stake in your business.

Be cognizant of how much equity you will be giving up in your Seed round. Every deal is different, and your startup valuation comes down to negotiation. Expect to give up 15% to 25% of the business in a Seed round as a general rule.

Early-stage companies are usually more insulated from public market downturns, so you might have to give up a few equity percentage points in a down market, but the growth you’re enabling with new capital will likely overcome any losses.

How to Secure Seed Funding for Startups

As someone who’s been on hundreds of calls with founders looking to secure Seed funding for their startups, I’ve seen patterns emerge. Here’s what seems to make early-stage companies successful:

- They network early and often.

- They do their research.

- They don’t get discouraged.

Most early-stage companies seek out Seed investors, not the other way around. The Seed fundraising process should begin well before you actually need the capital.

1. Network early and often.

You’ve maybe heard the acronym ABF: always be fundraising. That doesn’t mean you always need to sell pieces of your company, but you should constantly be engaged with potential investors to build connections.

Taking a network-centric approach to fundraising benefits everyone involved. It can be helpful to build a relationship with a potential investor over the course of months or years, rather than trying to go from introduction to Seed check in a matter of weeks.

Asking for money is always easier when you have a relationship or tie-in with your Seed investor. Additionally, you’ll be more confident that you’re getting an investor that can provide valuable expertise.

Keep your eyes out for incubator programs, demo days and networking events that can help you make connections. Chat with friends and former colleagues to find potential partners.

2. Do your research.

The range of Seed investors is wide. You’ll have single general partner firms with small funds, all the way up to multi-hundred million dollar venture capital funds.

You’ve got options, which makes it important to narrow your search and process. Do research to make sure your potential investor’s portfolio includes companies in your industry, stage and geographic region.

3. Don’t get discouraged.

You’re going to deal with rejection in the Seed fundraising process. Most companies we talk to take dozens of meetings before they find the right partners.

By definition, your Seed-stage company is an unknown. You’re bringing something new to a market — a future product or service for an industry or customer base — and the idea hasn’t taken full hold just yet. That’s why your company has money-making potential, but it also means some investors will be turned off by the uncertainty.

Ultimately, your Seed investors will share your vision and believe in the opportunity your business provides. All it takes is a “yes” from the right partner, and your seed is bound to grow.

York IE provides Seed funding for startups in B2B SaaS and other early-stage companies. Explore our investment opportunities.