In 2011, I worked for The Hippo, New Hampshire’s preeminent alternative weekly. I wrote a cover story on the rise of an obscure Manchester tech company called Dyn. The lede of that article went like this:

Kyle York had just finished a two-day multimillion-dollar sales pitch to a Los Angeles-based security company. As he gathered his breath, the executive whose business he was courting thanked York and asked if he had any questions. York, ever dauntless, dove right in: How did we do?

The executive responded: There was only one issue.

York wracked his brain. Was Dynamic Network Services, Inc. (Dyn), the Manchester-based managed DNS and e-mail delivery services provider he worked for, too small? Was his bid too high? What was the issue?

The executive answered for him: You’re in New Hampshire.

This infuriated the now 28-year-old York, who is Granite State born and bred. It was an all too familiar tune. As a rising technology company, Dyn had for years heard about how it should be in New York City or San Francisco. York was sick of it. He began passionately articulating New Hampshire’s many strategic advantages.

The executive told him not to be so defensive. It wasn’t New Hampshire specifically. It was just that Dyn was in a different time zone.

“Sometimes you try to overcome issues that are not even there,” York said.

Not long after that article was published, I joined Dyn. I spent the next 7 plus years working alongside Kyle, and a collection of talented people that rivals any assembled under a single company roof, to build Dyn into a global player. As we landed contracts from Amazon, Microsoft, Twitter, Pandora, Zappos, and eventually attracted the interest of Oracle, it didn’t seem to matter that we were in New Hampshire.

In fact, we helped direct the national spotlight on New Hampshire turning it into an up and coming tech ecosystem.

What Kyle once perceived as a negative actually became a positive.

The New Hampshire advantage is still alive and well today and plays an important role in our approach to investing. There is a joke I love that goes like this:

“A bar opens in Silicon Valley. A million people visit. No one buys anything. It is considered a smashing success.”

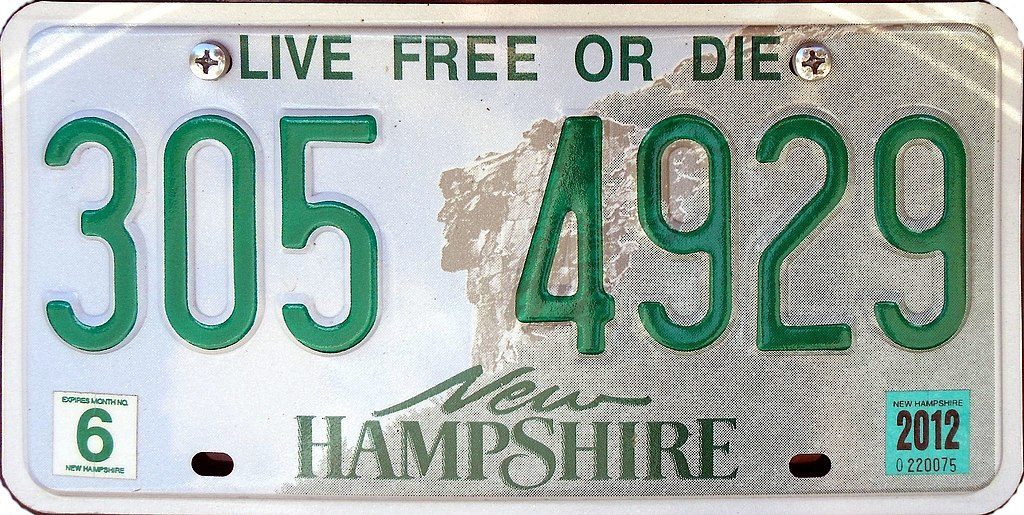

We don’t live in the Silicon Valley echo chamber. Our ethos on business and our desire to do it our way, is reflected in the official motto of the State of New Hampshire, which can be found on our license plates*:

Live Free or Die.

But there is a second part of that famous quote, penned by General John Stark on July 31, 1809, that is often forgotten but equally important:

Live free or die: Death is not the worst of evils.

No, death is not the worst of evils. It is far worse to have never lived. In my opinion, to be truly alive in a professional sense you must be in control of your destiny.

Having control and options is at the core of our approach. I’ve seen rapid growth companies that got massive funding and, as a result, lost their soul. I’ve also seen smaller companies who were never globally recognized but provided great opportunities for their employees and had fun every day. Lastly, I’ve seen scaling companies inject capital from investors who let them remain true to themselves and the ensuing rocket ship led to transformational wealth.

At York IE, we want to build good companies, not just fast exits. We think differently and understand how to build good businesses that solve real customer problems. We are also firm believers in doing it ‘our way.’ Our way bucks the trend.

It is said that only one out of ten startups succeeds. That’s why most investors are hunting for unicorns that can cover their losses. In New Hampshire we know how to hunt, which is why that stat is not reflective of our track record. We think the other nine startups can achieve varying degrees of success that can positively impact individuals and communities. You see, we love unicorns in New Hampshire but we also love moose and deer and cows. They’re all important to a robust ecosystem.

We believe in building an ecosystem, which is why we’re bias toward working with entrepreneurs who want to create more than profit. One of our core values as a company is rising tides raise all boats. We believe in shared success. Set a clear vision, rally your team to climb the mountain and when you get to the top reward those (employees, customers, partners, investors) who made it there alongside you. This is why we’re overly transparent and share all of our learnings both good and bad. We want to invest in the future and we think the best way to do that is to arm the next generation of entrepreneurs and angel investors.

We want to build something special and we want to do it in New Hampshire because we think it’s a special place.

I remember a few years ago sitting in a massive conference room in Oracle’s headquarters in Redwood Shores, California. We were meeting with Oracle executives about an event that was to take place in New Hampshire. I’ll never forget the look of disbelief on their faces when Kyle said he’d simply text Governor Sununu to attend. Oh, he could also text a local band with a national following if they needed music. Despite their millions of dollars in salary, the folks in that room didn’t have that reach. That kind of access and the willingness of the people on the other end of the text to help is rare.

It’s also why we know we can be successful investors in New Hampshire. Our entire careers have been about making a choice and then working relentlessly to ensure it was the right one. We chose to build a tech company outside the shadow of Silicon Valley. Now we’re choosing to build an investment firm beyond the deep pockets of New York or Boston.

But life is about choices. And to quote another legendary Granite Stater:

I shall be telling this with a sigh

Somewhere ages and ages hence:

Two roads diverged in a wood, and I—

I took the one less traveled by,

And that has made all the difference.