Annual recurring revenue (ARR) is a common financial and operating metric used in the world of SaaS and subscription-based businesses to measure forward-looking yearly revenue from any given point in time.

Despite its widespread use, ARR isn’t always black and white. Accurately interpreting or even calculating ARR can be confusing, but confidently nailing this metric (or at least explaining the assumptions behind your number) is pivotal for startup founders as they tell their fundraising story.

In this post, you’ll learn why ARR is important and discover the ARR formula we use at York IE to evaluate a company’s traction.

Why Is ARR Important for SaaS and Subscription Companies?

As active B2B SaaS investors and advisors, we at York IE are constantly being told where a company’s traction stands in terms of their annual recurring revenue. However, all ARR is not treated equally.

In addition, multiples on ARR is one the best ways for investors to benchmark the valuation of a startup and the market as a whole. Multiples are less commonly used at the earliest stage of investing, but buyout and growth-stage investors use a high and a low end of competitive multiples in order to get a range of an acceptable valuation.

With the emphasis placed on ARR by the funding ecosystem, the reality is that this seemingly straightforward metric can be difficult to calculate and speak confidently to.

How Is ARR Calculated?

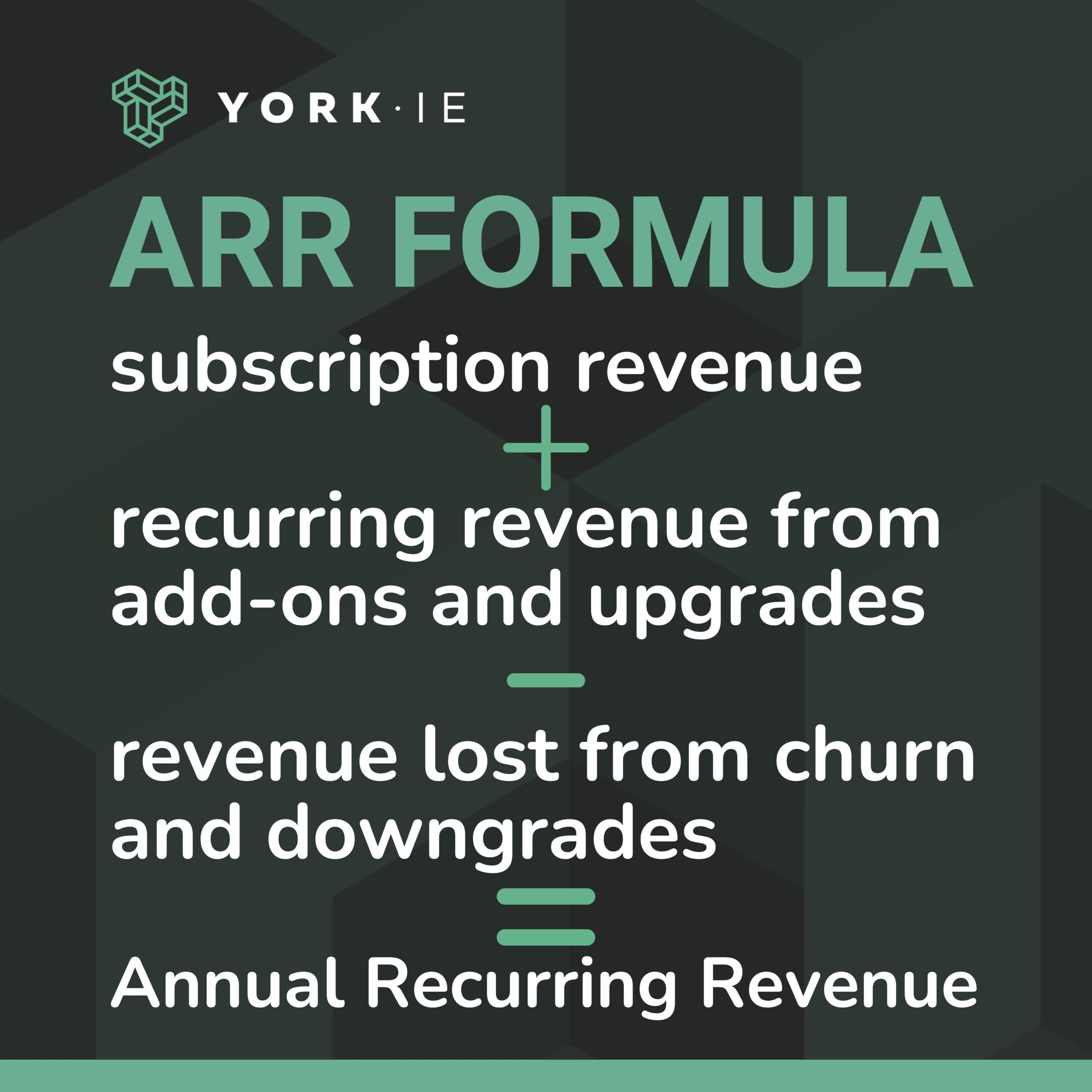

ARR is calculated by adding all subscription and recurring revenue and subtracting lost revenue. The factors in your ARR formula should include subscription revenue, recurring revenue from add-ons and upgrades and lost revenue from cancellations and downgrades.

To calculate ARR, use this formula:

ARR = subscription revenue for the year + recurring revenue from add-ons and upgrades – revenue lost from cancellations and downgrades that year

What’s the Difference Between ARR and MRR?

The difference between ARR and MRR is that ARR is the total amount of revenue that a business generates from its recurring subscriptions over the course of a year, while MRR is the total amount of revenue that a business generates from its recurring subscriptions each month.

Monthly recurring revenue (MRR) is calculated by adding up the monthly recurring revenue from all of a business’s customers. Annual recurring revenue is calculated by multiplying MRR by 12.

Both MRR and ARR are important metrics for SaaS businesses because they can be used to track growth, identify trends and make financial projections. MRR is a good metric to use for short-term planning, while ARR is a good metric to use for long-term planning and long-term valuations.

Different ARR Definitions

One of the main reasons why annual recurring revenue can be confusing for startups is that there isn’t one uniform way to calculate ARR from business to business (despite the formula above being fairly obvious). It is highly dependent on a company’s pricing model, product offerings, billing terms and customers.

For example, some companies may include only the subscription revenue from customers who are live on their platforms, while other companies may include revenue from the time of a signed contract. Other companies serve government agencies that will commit to multi-year projects but won’t allow for any auto-renewal terms in the contracts.

During the York IE diligence process, we’ve seen both types of revenue and customer situations be counted as ARR. While neither is necessarily wrong, the lack of a standardized ARR definition can result in inconsistent calculations and make it perplexing for startups and investors to compare their numbers with industry benchmarks or competition.

Examples of Non-Recurring (But Ongoing) Revenue

Startups often have non-recurring revenue streams that will impact how they calculate ARR. Non-recurring revenue includes one-time payments from customers for services such as implementation, setup or training.

While these revenues may contribute significantly to a startup’s overall revenue, they are not part of the recurring revenue stream that ARR is intended to measure. However, different companies may have different approaches to treating non-recurring revenue in their ARR calculation.

For example, usage-based pricing is catching fire due to its ability to align payment with customer value. However, this has thrown a wrench in how to calculate ARR. For example, public company HashiCorp, an infrastructure automation software provider, charges on a per-hour basis. As a result, they multiply the prior month’s consumption by 12 to estimate annual consumption:

“We define ARR as the annualized value of all recurring subscription contracts with active entitlements as of the end of the applicable period, and in the case of our monthly, or consumption-based customers, the annual value of their last month’s spend.”

On the other hand, application security software company Dynatrace also prices on various usage metrics depending on the product but calculates ARR differently:

“We define annual recurring revenue, or ARR, as the daily revenue of all subscription agreements that are actively generating revenue as of the last day of the reporting period multiplied by 365. We exclude from our calculation of ARR any revenues derived from month-to-month agreements and/or product usage overage billings, where customers are billed in arrears based on product usage.”

It’s evident that some companies may choose to exclude non-standard recurring revenue altogether, while others may choose to include it. This inconsistency can lead to confusion and discrepancies in ARR calculations, making it difficult to accurately assess a startup’s true recurring revenue performance.

Timing and Recognition of Revenue

The timing and recognition of revenue can also impact the accuracy of ARR calculations for startups. Revenue recognition is an important accounting principle that determines when revenue can be recognized in a company’s financial statements.

For subscription-based businesses, revenue recognition can be complex due to factors such as billing cycles, contract durations and payment terms. Startups may face challenges in aligning their revenue recognition policies with their ARR calculations, especially if they have different billing cycles or contract durations for different customers.

Inconsistent revenue recognition practices can result in variations in ARR calculations, leading to confusion and misinterpretation of a startup’s financial and operating performance.

How Changing Business Models Affect ARR

Further complicating how to calculate ARR, natural pivots of business models are expected as part of the startup journey. As a company grows, its customer base and revenue streams may evolve, leading to changes in pricing, packaging and contract terms.

These changes can impact the accuracy of ARR calculations moving forward, which makes it hard to compare present to past. The reality is that startups may need to adjust their revenue recognition policies or redefine their ARR definition to reflect their changing business dynamics.

Be Transparent About Your ARR

So after all of these potential challenges, how should startups and scaling companies think about generating their annual recurring revenue number? The reality is that there isn’t a bulletproof way to get to a final answer.

Most public SaaS companies that have to report out on their finance metrics quarterly will include their own ARR definition. For startups it should be no different.

While presenting your ARR metrics internally or to potential investors, make sure you outline your assumptions behind that number, how your pricing model and product offerings feed into it and any changes that you have had to make over time. It’s hard for outsiders to conceptualize revenue results when they don’t know how the sausage is made.

Overall, the more important point is to be transparent about how you calculate ARR and how you think about this number. No investor is going to fault you for not being a finance wiz in the early days as a founder, as long as you have a strong understanding of your business model.