Wondering how to find investors for a startup business? Follow these five tips:

- Tap into your network.

- Be creative with social media.

- Attend events with investors.

- Join a crowdfunding platform.

- Use an investor research tool.

Some founders bootstrap their way to unicorn status, but that’s not always possible. Most startups need investors — not only for capital that supercharges growth but also for the expertise and industry connections that spur sustainable scaling.

Nearly 40% of startup failures are a direct result of an inability to raise new capital, according to CB Insights. The best way to avoid this common hurdle is to build and maintain a network of investor contacts that fit the needs of your growing company. The more investor options you have, the more likely you are to find your next deal and extend your runway.

To find investors for a startup, you’ll first need to understand the common sources of funding, as well as the strategies and tools you can use to connect with the right people.

Find Startup Investors

Our investor research tool makes it easy.

TRY IT OUT

Table of Contents

- Where to Look for Startup Investors

- How to Find Startup Investors with York IE Fuel

- Simplify Your Quest to Find Startup Investors

Where to Look for Startup Investors

Successful entrepreneurs will often source their startup’s funding from some combination of:

- angel investors;

- venture capital and investment firms;

- incubators and accelerators;

- crowdfunding; and

- loans and debt financing.

1. Angel Investors

Angel investors tend to be high-net-worth individuals who invest on their own — independent from a larger family office or investment firm. These investors typically invest their own money in early-stage companies and are often the first source of outside capital for many organizations.

Angel investors will often act as a mentor, providing strategic advice and guidance to founders. But they also come at a price. Angel investing is inherently risky because of the unproven nature of young companies; an angel investor’s capital may require upwards of 20% equity in your company, according to the angel investor community AngelMatch.

Communities such as AngelMatch, AngelList and The Angel Capital Association can help entrepreneurs find their angel match.

2. Venture Capital and Investment Firms

Venture capital firms are some of the most common sources of capital for startups. Most VC firms source their capital from a pool of limited partners (LPs) and make strategic investments in startups using the LPs’ money, in exchange for equity. (The firms primarily make money from the management fees they charge to their LPs.)

VC firms have more resources than angel investors, and they often provide strategic advice and introductions to potential customers or partners. Startups that receive VC funding typically must be acquired or go public in order for their VCs to deliver positive returns to their LPs.

Investment firms such as York IE take a different approach, aligning their incentives more closely with their entrepreneurs’ and ditching the management fee structure. It’s up to you to decide if a firm’s vision matches with your ultimate goals.

3. Incubators and Accelerators

It can be helpful to think of incubators and accelerators as schools for startups. These programs provide capital, resources, mentorship and (sometimes) office space to early-stage companies, usually in exchange for equity.

An incubator is typically for companies in the idea stage, whereas an accelerator is for organizations with a little more infrastructure and traction. Both programs operate in a similar way: Over the course of a few months or years, founders receive guidance and support from experienced entrepreneurs and business professionals. Upon graduating from the program, companies often gain access to a network of investor contacts.

4. Crowdfunding

The internet is a powerful place, and collective action can sometimes supercharge growth for early-stage companies.

Founders can post about their company on crowdfunding websites such as Kickstarter, Indiegogo, WeFunder and OurCrowd. Anyone on the internet can then pledge money towards their company, usually in exchange for rewards or other benefits such as early access to products and services.

Relying solely on crowdfunding isn’t a sustainable strategy, but it has benefited some big-name brands such as Oculus VR, Allbirds and PopSockets.

5. Loans and Debt Financing

Debt doesn’t have to be a dirty word for startups; in fact, it’s often a very useful vehicle for fundraising.

Startup loans and other traditional forms of financing involve borrowing money from banks or other lenders in exchange for interest payments over time. These options help founders get capital quickly, usually without the need to sell equity.

Debt deals can be structured in multiple ways, such as revenue-based financing (where payments back to the lender are tied to a percentage of future revenue) and venture debt (where the lender receives interest payments and a right to buy equity at a discount in the future).

Now that you’re more familiar with the different sources of funding, it’s time to explore the steps you need to take to find investors for your startup business.

1. Tap Into Your Network

Your next investor startup investor might not be far away. Before you start sending out dozens of cold emails and LinkedIn messages, try reaching out to contacts that are already in your network. It’s OK if your friends, family and colleagues aren’t investors themselves; they might know people who are. A warm intro is usually better than a cold one.

2. Be Creative with Social Media

LinkedIn and Twitter can be great places for you to network with, engage and find startup investors. And don’t forget about other social media platforms, too. Do some research and look through your connections and followers to find new investor contacts. Share posts explaining your company’s goals and how an investor could help you achieve them.

And don’t forget the “social” part of social media. Try commenting on trending posts about your industry to put yourself in front of potential new contacts. Once you’ve engaged with someone in the comments section, it’s easier to send them a direct message and start a true conversation.

3. Attend Events with Investors

In most cases, investors won’t come to you; it’s important to meet startup investors where they are. There are plenty of events and conferences — many of which you can attend for little or no cost — dedicated to connecting entrepreneurs and investors.

Keep an eye out for pitch competitions, trade shows, conventions and hackathons in your area — or visit a co-working space for startups. Wherever you go, be prepared with an elevator pitch about your company and have a clear plan for what you’d do with new capital.

4. Join a Crowdfunding Platform

We mentioned some big-name companies that got a boost from crowdfunding; could your company be next? Make an account on a crowdfunding platform such as Kickstarter, Indiegogo, WeFunder or OurCrowd. See if you can drum up excitement for your product by offering exclusive benefits to anyone who pledges money to your page.

5. Use an Investor Research Tool

It’s possible you’ve dialed every number in your cell phone, attended a dozen startup mixers and used up all your LinkedIn Premium connections trying to find startup investors. These efforts can certainly lead to investor conversations, but shouldn’t there be a better, faster way to narrow down your startup fundraising search?

York IE Fuel makes the investor hunt easier with its Investor Research tool. Whether you’re turning over every stone looking for a first investor, or just seeking to add a new complementary skill set to your board, Fuel helps you find the right firms to work with.

You can search for investors that are active in your location, or look for firms that tend to work with startups in your stage and market. Keep reading to learn how.

How to Find Startup Investors with York IE Fuel

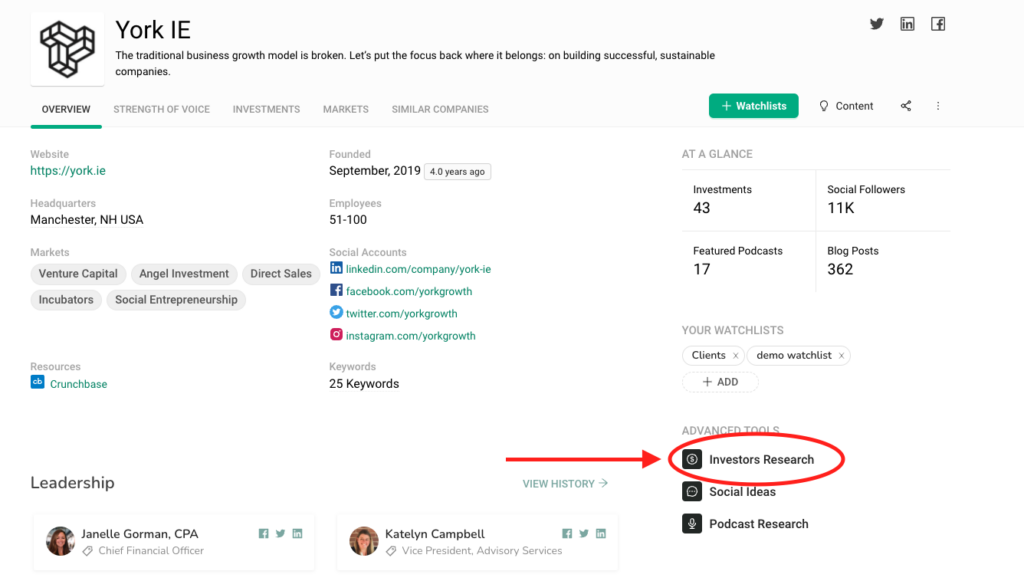

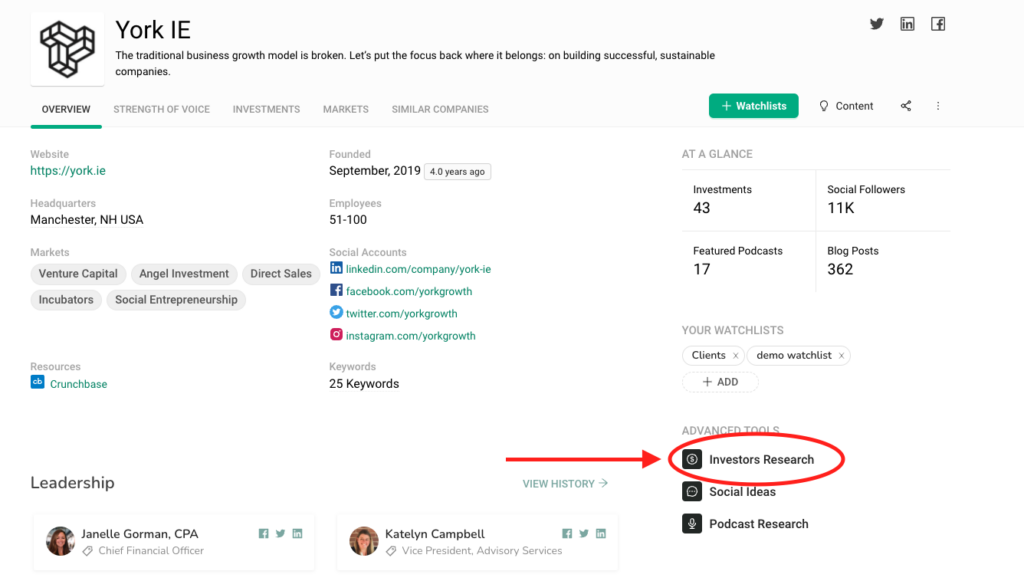

To start using the Investor Research tool, navigate to the Advanced Tools tab on the left side of your Fuel homepage. Select Investor Research, which is right above Social Ideas and Podcast Research.

To start using the Investor Research tool, navigate to the Advanced Tools tab on the left side of your Fuel homepage. Select Investor Research, which is right above Social Ideas and Podcast Research.

You can also access the tool on the right side of a company’s profile page. Once again, look under Advanced Tools.

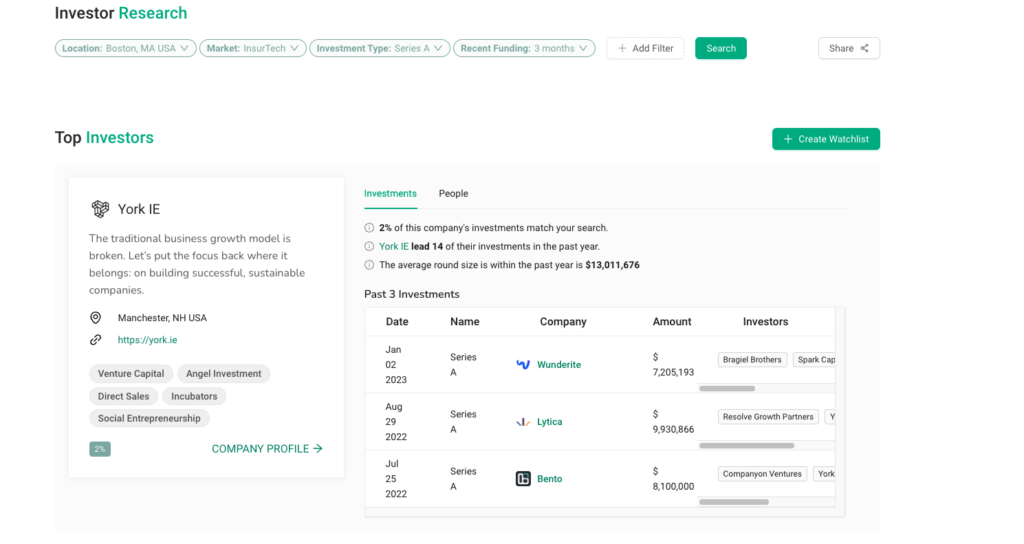

1. Search by Location

To begin, you’ll need to filter investors by location: city, state or country.

Keep in mind, the location filter allows you to find investors that invest in companies based in this location. If you start your search in Boston, for example, that doesn’t mean that the investment firms shown are also based in Boston. You might find an investor based in California or India; that just means that they’ve deployed capital to a Boston-based startup.

2. Add Filters

Now the fun begins. It’s time to narrow your search. Click the Add Filter button next to the Search button. You’ll now be able to find startup investors based on the following criteria

- Location: Displays VCs and firms that have invested in startups that are based in this location

- Market: Showcases investors that have put capital towards a certain sector (FinTech, cybersecurity, etc.)

- Companies: Shows which investors have made deals with a particular company

- Collaborative Investors: Finds firms that have participated in a funding round with a particular firm

- Investment Type: Displays investors that have been involved in a particular round or stage

- Recent Funding: Displays firms that have invested over a certain time period

3. Search for Startup Investors

Hit the Search button and you’ll see information on up to 10 investors that match your search criteria. If you search for Series A investors in Boston, for example, all of your results will be investment entities that were involved in a Boston-based company’s Series A round.

Hit the Search button and you’ll see information on up to 10 investors that match your search criteria. If you search for Series A investors in Boston, for example, all of your results will be investment entities that were involved in a Boston-based company’s Series A round.

On the left side of the screen, you’ll see basic information about the investor: firm name, slogan, location, the investor’s top markets and links to the firm’s website and Fuel company profile.

4. Explore Your Results

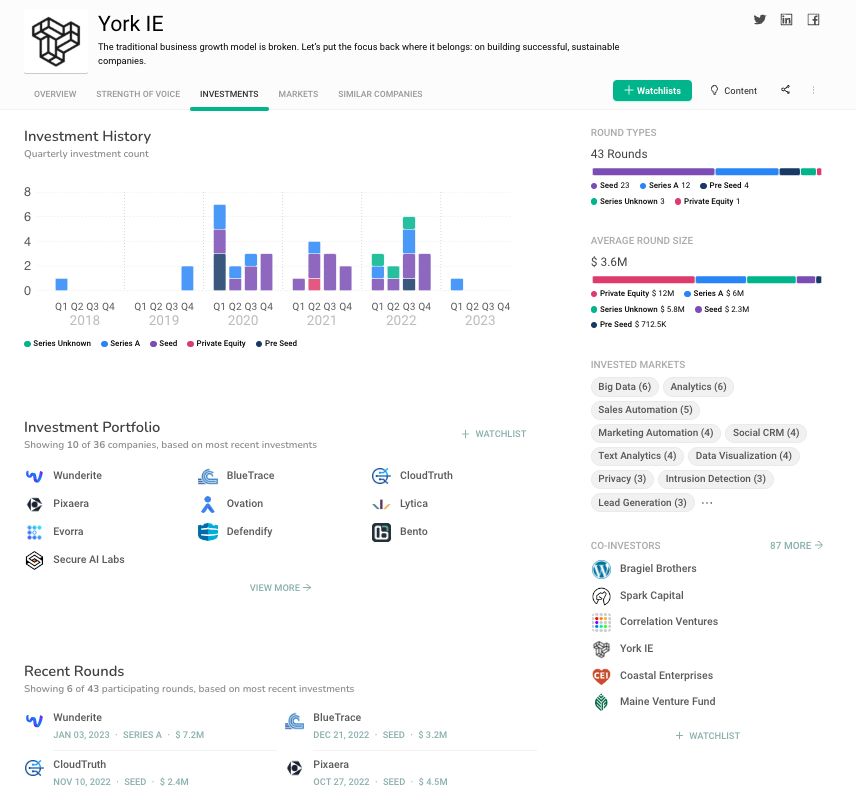

Under the Investments tab on the right side of each result, you’ll find valuable information for your investor search.

You’ll see a matching percentage — the portion of that investor’s capital that was deployed within your criteria. Fuel also tells you how many rounds that investor has led, as well as the average round size.

Additionally, you’ll find information on the three most recent investments by that investor. These three rounds don’t necessarily match your criteria, but they do give you insight into recent activities by your potential new VC partner — including collaborative investors that also participated in these rounds.

Switch over to the People tab to see which investors from the firm to contact, along with their social media profiles. (Note: This tab will only be populated if the firm lists its contacts online.)

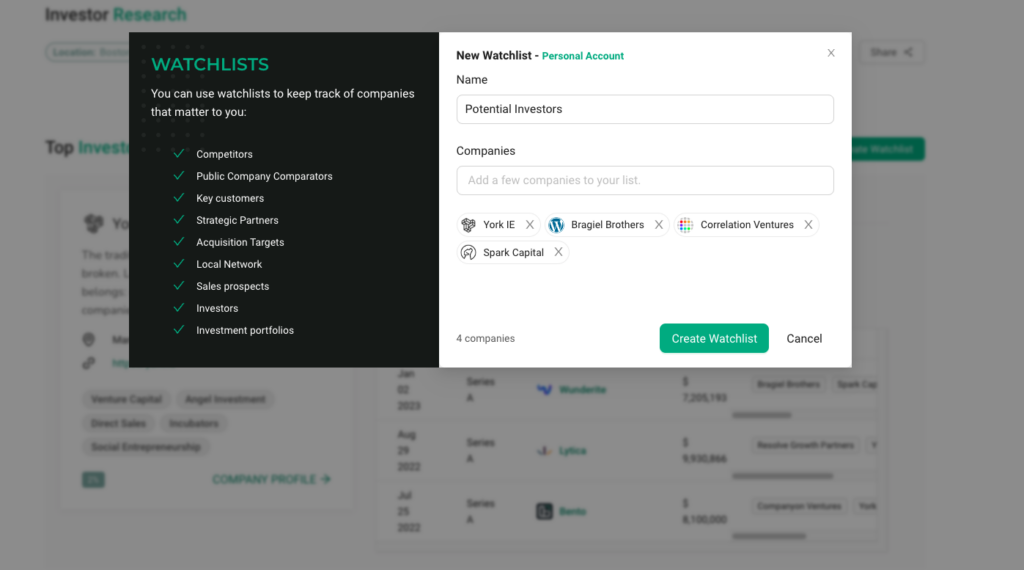

5. Create a Watchlist from Your Results

Now that you’ve found a pool of potential investors, you can click the Create Watchlist button to easily track your new targets in one place. You can stay up to date with these firms’ latest investment activities in one place.

Now that you’ve found a pool of potential investors, you can click the Create Watchlist button to easily track your new targets in one place. You can stay up to date with these firms’ latest investment activities in one place.

6. Dig Deeper into Specific Investors

Creating a watchlist from your results is a great start, but perhaps you’d like to find out more about specific investors that came up in your search. Fuel makes it easy.

Creating a watchlist from your results is a great start, but perhaps you’d like to find out more about specific investors that came up in your search. Fuel makes it easy.

Click the Company Profile button next to any investor that appears. Once you arrive at the Company Profile page, click the Investments tab to see an in-depth analysis of that firm’s investment history. You’ll find information such as average round size, invested markets and other companies the firm invested in.

You’ll also find the firm’s co-Investors, with the option to create a separate watchlist with these similarly-aligned firms. Increase your options by tracking other like-minded investors.

Simplify Your Quest to Find Startup Investors

Founders and early-stage employees have a lot on their plates: new business, building the product, recruiting new hires, etc. Conducting investor research on top of all of this can be overwhelming.

Fuel’s Investor Research tool offers a way to streamline the process, so you can spend less time doing cold outreach and making hopeful trips to in-person startup events. We recommend targeting investors with a history of investing in your location, market and stage, so you can save time for other essential startup scaling activities.