Revenue models help companies predict bookings and revenue from the products and services they offer to customers. There are many different types of revenue models, and choosing the right one for your startup can make all the difference.

Forecasting your revenue is essential. Revenue streams and expenses should go hand in hand, with one having a significant influence on the other.

When CFOs and founders have confidence in their revenue numbers, they can invest in sales, marketing, new hires and product development. And they can make sure they have funds to cover those expenses. Expenses properly spent will drive revenue growth, creating a healthy, growing business.

You and your colleagues will only achieve (and maybe even exceed) your revenue goals by presenting your products and services in a way that appeals to customers — and differentiates you from the competition. And that’s why you need to have a solid understanding of the different types of revenue models you could use.

What Is a Revenue Model?

A revenue model is a framework to predict revenue performance and results over a period of time. Revenue models take into account the various ways your company generates revenue, also known as revenue streams.

They also factor in the fixed and variable expenses the business incurs in order to generate that revenue. Many elements inform your revenue model, including:

- pricing and packaging;

- lead conversion to bookings;

- quota carry; and

- net revenue retention.

With a clear understanding of the inputs, a revenue model can be used to create quantifiable booking and revenue forecasts that will drive your budget and rolling forecast.

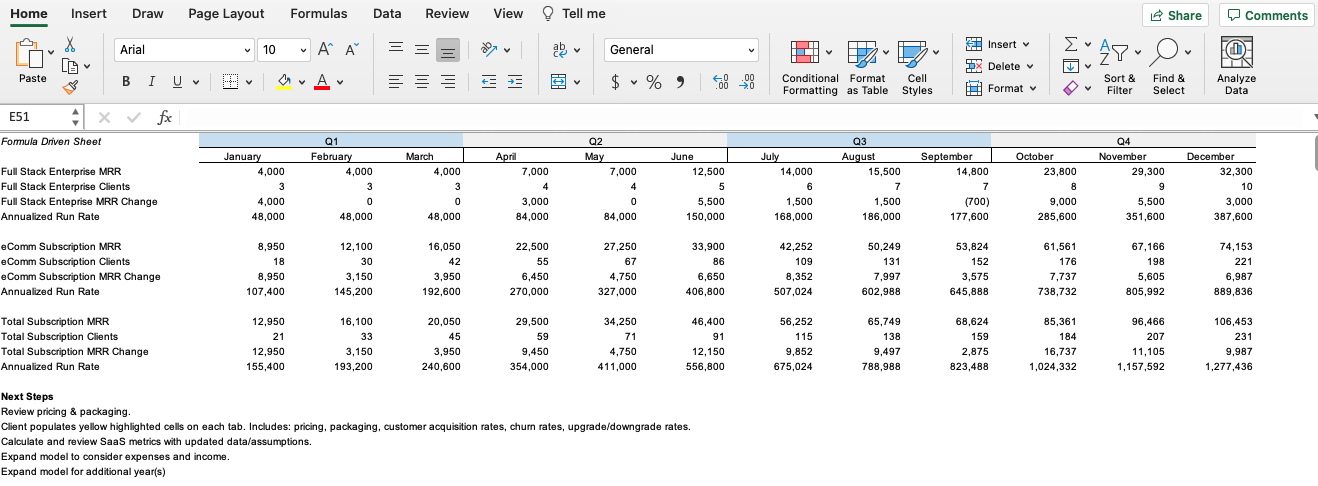

Free Financial & Operating Model Template

Choose the right model for your company and start building it out today.

DOWNLOAD NOW

Business Model vs. Revenue Model vs. Revenue Stream

A revenue model is a forecast of how a company expects to experience bookings and realize revenue. It is one component of a business model, which is a broader foundational strategy that encompasses many more financial elements and business operations. And a revenue stream is a subtly different concept.

“Business model” and “revenue model” are sometimes used interchangeably, but they’re not the same thing. A business model covers all the processes necessary for a company to create value for customers and earn a profit, such as product development, human resources, marketing and sales.

Your revenue model predicts and forecasts what your revenue is going to be, while revenue streams are inputs into that forecast. A company could have multiple revenue streams that are all accounted for in the revenue model strategy.

A revenue stream defines where your revenue comes from by answering questions such as:

- What are you selling?

- How much are you selling it for?

- Who are you selling it to?

All of your startup’s revenue streams — defined and forecasted over time — will make up your revenue model.

Types of Revenue Models

The five most popular types of revenue models are:

- recurring revenue models

- transaction revenue models

- affiliate revenue models

- advertising revenue models

- usage-based revenue models

Let’s take a look at each of these and share some revenue model examples:

1. Recurring Revenue Models

A recurring revenue model usually involves some sort of subscription or membership fee that provides the customer with goods or services with a regular billing cadence.

Examples: Gyms charge monthly fees to gain access to their facilities. You can get just about any product through subscription services nowadays, from contact lenses to beauty products to meal kits. Of course, you can also purchase SaaS applications on this basis.

Advantages: Companies love recurring revenue because it’s predictable, which makes budgeting and planning easier. This model may increase customer engagement, because customers might use your product or service more frequently since they’re already contracted to pay for it.

Disadvantages: Customers might be less willing to commit to a product they have to continuously pay for. They may be hesitant to subscribe at a flat rate if they believe the platform won’t be adequately utilized on an ongoing basis.

2. Transaction Revenue Models

Direct-to-consumer businesses and other sellers of goods rely on the sales revenue model to forecast revenue for goods shipped to their customers. This type of sale results in a different revenue recognition pattern and therefore is modeled separately from a subscription revenue forecast.

Quantity or units shipped may vary significantly throughout the year, and revenue trends may fluctuate with seasonal trends or capacity constraints.

Examples: buying a coffee from a cafe, ordering a dress from your favorite retailer’s website or purchasing one-time access to a movie on-demand.

Advantages: It can be easier to attract new customers; they’re making a one-time purchase for services or goods as needed, and they’re typically consuming it right away without any commitment to ongoing spend.

Disadvantages: Transaction revenue is significantly more variable. It’s difficult to predict customer behavior, which could change based on seasonality, market trends or other unique factors within each business.

3. Affiliate Revenue Models

Third-party sellers and platforms are the main proponents of the affiliate model, which is based on commission. This type of model is often based on macro trends, given that the bookings are one step removed from the team — and therefore influenced more by larger campaigns than on an individual client basis. Similar models, such as channel or reseller markets, also rely on a third party to connect the seller to its end user.

Examples: Anytime you make a purchase on Amazon, Etsy or eBay, those sites get a percentage of the sale.

Advantages: Affiliate revenue models have low overhead costs, as the affiliates are largely responsible for employing sales teams and funding sales efforts to close revenue deals. This can result in more passive income for the company if the affiliates perform well.

Disadvantages: When selling through affiliates, the business has less control over its sales process to end users. This creates inherent risk in the form of poor user experience, decreased brand credibility or ineffective or insufficient sales efforts by the affiliate. Any of these factors can negatively impact bookings.

4. Advertising Revenue Models

Advertising can be a significant source of revenue for publications or other platforms with access to a large audience. Any website or content platform can generate revenue by offering ad space to another seller. This revenue model is typically based on a B2B contract for the advertisement itself, rather than any customer behavior or end-user booking.

Example: A SaaS platform links relevant merchandise in its articles, newsletters or web pages so its audiences are exposed to products they may be interested in. The SaaS platform is paid for the advertising placement regardless of its audience’s interaction with it.

Advantages: The business doesn’t have to do much work to initiate an advertising revenue model. Your advertiser makes their own ad and purchases the space. It’s not up to your company to ensure that any customers click on the ad.

Disadvantages: While advertising could be an easy revenue boost, it might also affect your user experience. Perhaps advertisements bother your users. Is the extra revenue boost worth negatively affecting their experience?

5. Usage-Based Revenue Models

This model, as the name suggests, charges customers based on how — and how much — they use a product. Included within this model is the freemium strategy. Companies using the freemium strategy will offer a free, baseline product or service to customers while also enticing them to pay extra for additional features, services or expertise. Common services such as LinkedIn, Dropbox and WordPress fit this description.

While there is no direct revenue to forecast from a freemium model, tracking your user base and their behavior is important. That information is critical to predict upgraded revenue in the subscription model, and may also be used to determine pricing for advertising or affiliate programs.

Examples: Cell phone companies deploy a usage-based model when your monthly bill is correlated to how much data you used. Similarly, you’re usually charged by the pound at a salad or hot bar at the local grocery store.

Advantages: Customers generally appreciate that they’ll only be billed for what they use. A usage-based model offers more flexibility than a recurring subscription because companies can dial up or down based on their needs.

Disadvantages: Predicting revenue is difficult with this model because it is dependent on customer behavior, which is inherently variable. This could force a company into a more conservative financial forecast to avoid overspending in a period of unexpected usage decreases.

How to Choose the Right Revenue Model

The keys to choosing the right revenue model are: getting to know your customers, embracing multiple revenue streams and being flexible.

Get to Know Your Customers

Rather than assuming what they’d like, get in the trenches with your customers and learn their preferences. Find out what types of revenue models your competitors are using. Do they work, or would customers prefer something different? Customers have to embrace your offering for your startup to succeed.

Embrace Multiple Revenue Streams

It’s possible to monetize your startup’s offering in multiple ways. Perhaps you can sell a product directly to consumers on your own website and offer it through a third party such as Amazon. Maybe you can sell your software with a recurring revenue subscription and offer white-glove services.

Be Flexible

Flexibility is one of the most important aspects of startup success. Don’t be rigid with your revenue model. The ability to pivot and be agile in your response to the market will be critical to your early success.

Continuously gather customer feedback and monitor your sales metrics. When you see a meaningful opportunity to change your model, go for it! Don’t make changes every month (which could be confusing for customers), but don’t be afraid to adjust, experiment and adapt.

How Do I Build a Revenue Model?

To build a revenue model, follow these steps:

- Define your offering(s).

- Define your target audience(s).

- Solidify your pricing and packaging.

- Calculate how many leads and bookings you’ll need.

- Set appropriate quotas for those leads and bookings.

- Factor in churn and net revenue retention.

As I always say, the most important part of scaling your business is getting started. You might not know everything about revenue models, but at York IE, we’re here to help!