This past Monday Data-and-AI focused cloud company, Databricks, announced a $1B round led by Franklin Templeton with additional involvement from Fidelity, Whale Rock, AWS, CapitalG, and SalesForce Ventures among others. This billion-dollar round takes Databricks’ post-money valuation to $28B, exceeding the $25B IPO valuation of cloud competitor, Snowflake, which took place last September. The deal, Databricks says, will allow them to execute on strategic M&A while they look to stay on the bleeding-edge of AI innovation.

Why this transaction?

The York IE team chose this as our transaction of the week to talk about the rapid growth within the data analysis/AI cloud market. Databricks’ recent announcement adds them to a growing list of data companies raising huge amounts of capital via crowded investment rounds and IPOs. As the collection and creation of data continues to accelerate across industries, enterprises are looking for new ways to analyze and sort their expanding number of datapoints. In a recent report, the IDC projected that by 2024, 149 zettabytes would be “created, captured, copied and consumed” each year (1ZB = Roughly 1 billion TB’s), this number has created a massive market for startups looking to help enterprises with their raw data. With this market continuing to expand, companies like Snowflake are addressing data storage needs with their cloud-based data warehouse, hoping to eliminate the management and infrastructure hurdles enterprises face with data storage. Databricks on the other hand has taken a separate approach and focuses on the relationship between engineers and data scientists; the company’s unified analytics platform offers a suite of open-source products, making data storage and management intuitive for enterprise users. Although Databricks and Snowflake may appear to be competitors, a strategic partnership between the two solutions allows enterprises to prepare data using Databricks’ storage layer for later storage in Snowflake’s SQL data warehouse; users can then go back and perform analysis/manipulation on large amounts of data using a Databricks notebook.

Big Data Takes Center Stage

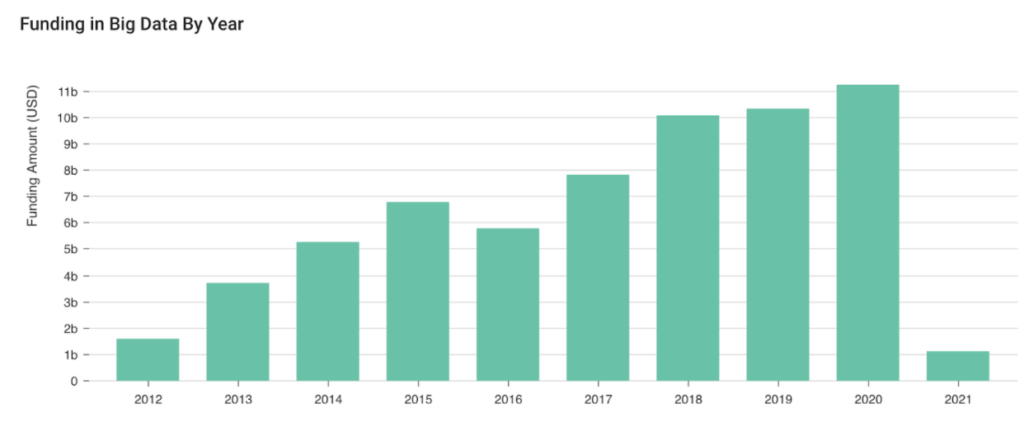

As we continue to enter the digital age, more and more industries are creating, analyzing, and acting on their raw data. Organizations deploying solutions like the ones mentioned above gain a competitive edge against the rest of the market; by storing and analyzing raw data, companies are able to better address customer needs. Taking a deeper look at this market, the York IE team compiled data related to funding in big data looking back ten years:

In the graph above, you can see how the big data market has been growing at a consistent rate for over a decade. Interestingly, funding in the first month of 2021 alone, has almost eclipsed the total funding in big data for 2012. Given the expectation that more data will be created in the next three years than the previous thirty, we expect continued growth within the big data market. As organizations continue to create more and more raw data, they will continue to rely on companies like Snowflake and Databricks to store and analyze that data.