A month is a significant unit of time in the life of a startup, which makes having a monthly close checklist especially important for cash-strapped early-stage companies.

Every startup management team needs up-to-date information on the company’s financial health. Real-time data can support real-time decisions, and accounting teams are responsible for delivering this. But it’s impossible for accountants to close out every transaction on a daily basis. Because of the fast-paced nature of startups, quick feedback is critical to balance investing in growth and maintaining financial health. Waiting until the end of the year to close out the books means you’re not able to deliver that frequent, meaningful feedback to key stakeholders.

Following a monthly close process provides 12 checkpoints throughout the year where bookkeepers can ensure their financial records are complete and accurate. With each monthly report, management and other stakeholders receive vital feedback that allows them to shift strategy.

Need some help tackling the monthly close process? I’ll provide some key insights in this article and share our accounting monthly close checklist.

What is the Monthly Close Process?

The monthly accounting close is conducted to ensure that all of a company’s financial transactions are accurately recorded, analyzed and reported out each month.

Companies don’t have real-time insight into their month-to-date revenue or cash in the bank. That’s surprising to many. Activities such as bank transactions, invoices to customers and invoices from vendors are happening at warp speed each day. Thus, accountants take a few days at the end of the month (five to seven business days is usually a good benchmark) to re-check that everything is correct and balanced in the ledger.

Once these transactions are recorded, finance professionals will distill the results into meaningful analysis. Similar to a financial forecast, these monthly reports provide predictability and accountability while allowing leadership to make timely pivots. This is only possible with accurate records.

Get Your Monthly Close Checklist

What to Include in the Monthly Close

Every company conducts its monthly close differently, with varying levels of reporting and analysis. A streamlined monthly close checklist will help you validate the completeness and accuracy of cash flow and net income transactions. The essential process confirms things such as:

- profit and loss statement reflects all income earned and expenses incurred for the month;

- all cash flow transactions are properly recorded; and

- the company understands what balances are outstanding with its vendors and customers.

These four elements are consistent pillars of a sound monthly close:

Accounts Payable

Most of your startup’s expenses will run through your accounts payable (AP) ledger. The AP balance is made up of vendor invoices received, less payments distributed. The AP balance translates to: What do I owe to vendors for the products and services they’ve provided to my business?

Understanding what was paid, what is owed and how the account is trending is a great way to validate that your expenses are recorded and cash flow is sufficient to meet vendor commitments.

Accounts Receivable

Accounts receivable (AR) is the reverse of accounts payable. AR answers the question: What do my customers owe me for the products and services I’ve provided to them?

If the balance is increasing, it may indicate that your customers are having a hard time paying the invoices you send them — a sign of trouble. Alternatively, customers could pay in advance, as is the case for e-commerce transactions. That means you don’t have an AR balance. Instead, you may review customer bills and payments, which happen simultaneously.

Validating that customer billing and payment are complete and accurate is an important monthly process, whether or not you have open receivables from customers.

Cash

If you include nothing else in the monthly close process, include cash. Reconcile what cash came in, what went out and the balance of what you have left. Cash flow is one of the most important metrics for keeping your business alive in the early days.

Deferred Revenue

Deferred revenue exists when a customer pays in advance. It is a liability account that essentially indicates that you owe something to your customer. That something is your company’s goods or services.

For example, if your customer pays $1,200 on Jan. 1 for a subscription service through Dec. 31, you owe them that value over a 12month period. Each month, you would recognize $100 of revenue and maintain a balance of deferred revenue until the service period was delivered in full. Deferred revenue doesn’t apply to every startup. If it does apply, it’s incredibly important to keep it accurate, so you’ll want to close it out each month.

How the Monthly Close Process Works

I advise startups to take a balance sheet approach to monthly reconciliation. When thinking of the basic financial statements, the balance sheet provides a snapshot of assets, liabilities and equity at a specific moment.

If you can feel confident that the balance of those accounts are accurate and supported, you can gain comfort that all transaction activity over the course of the month is accurate. You can complement that reconciliation process with an analytic review of income and expense activity and trends.

Below are four simple steps to follow each time you engage in the monthly close process, with a staff member assigned to each one. Some startups don’t have a full accounting team, so there can be overlap here.

Before you start the process, you’ll of course have spent the entire month keeping up with your transactions as you go along. Then, the fun begins.

Step 1: Make sure every transaction is recorded

Double check that you haven’t missed any transactions from the month. This is typically handled by the staff accountant.

Step 2: Review/reconcile the outputs

You don’t have to review every single transaction each month, but a senior accountant will want to reconcile account balances (think: bank reconciliations) as a gut-check on the transactions and validation of the ending balance.

Step 3: Analyze the numbers

Usually handled by the controller, this step involves producing analytical report(s) (budget-to-actual analysis, cash movement report, customer bookings report, etc.) in addition to an updated balance sheet and income statement.

Step 4: Report the results

Why do all this number-crunching if you don’t share the insights? Provide your management team and key stakeholders a synthesized, simplified version of your monthly close. Include commentary that may be helpful to inform business decisions by highlighting trends, balances and key performance indicator results. This may include customer billing and payment trends, allocation of expenses by cost classification, changes in revenue by product, gross margin analysis and more.

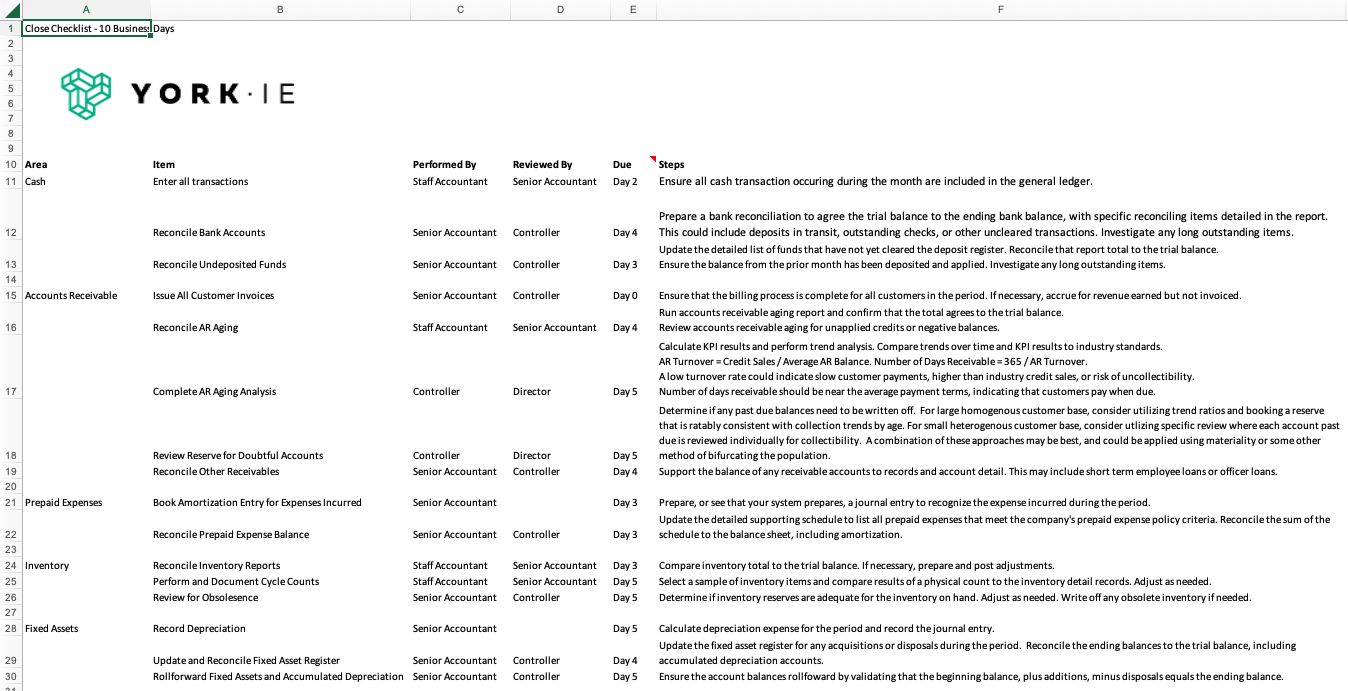

Monthly Close Checklist

The information above is a good starting point. For a full guide on effectively closing accounts at the end of each month, download the monthly close checklist from our Fuel platform.

The information above is a good starting point. For a full guide on effectively closing accounts at the end of each month, download the monthly close checklist from our Fuel platform.

Don’t get overwhelmed by the size of this checklist; you don’t have to check every single item each month. We included all of this detail so you can customize the monthly close checklist for your startup’s accounting and reporting needs.

For monthly close, you might only need to complete 50% of the tasks on our checklist. More robust quarterly closes might require 80% of these items, and your thorough year-end close will likely include every item, plus some additional tasks relevant to your business.

Start producing meaningful analysis for your startup’s leadership team!