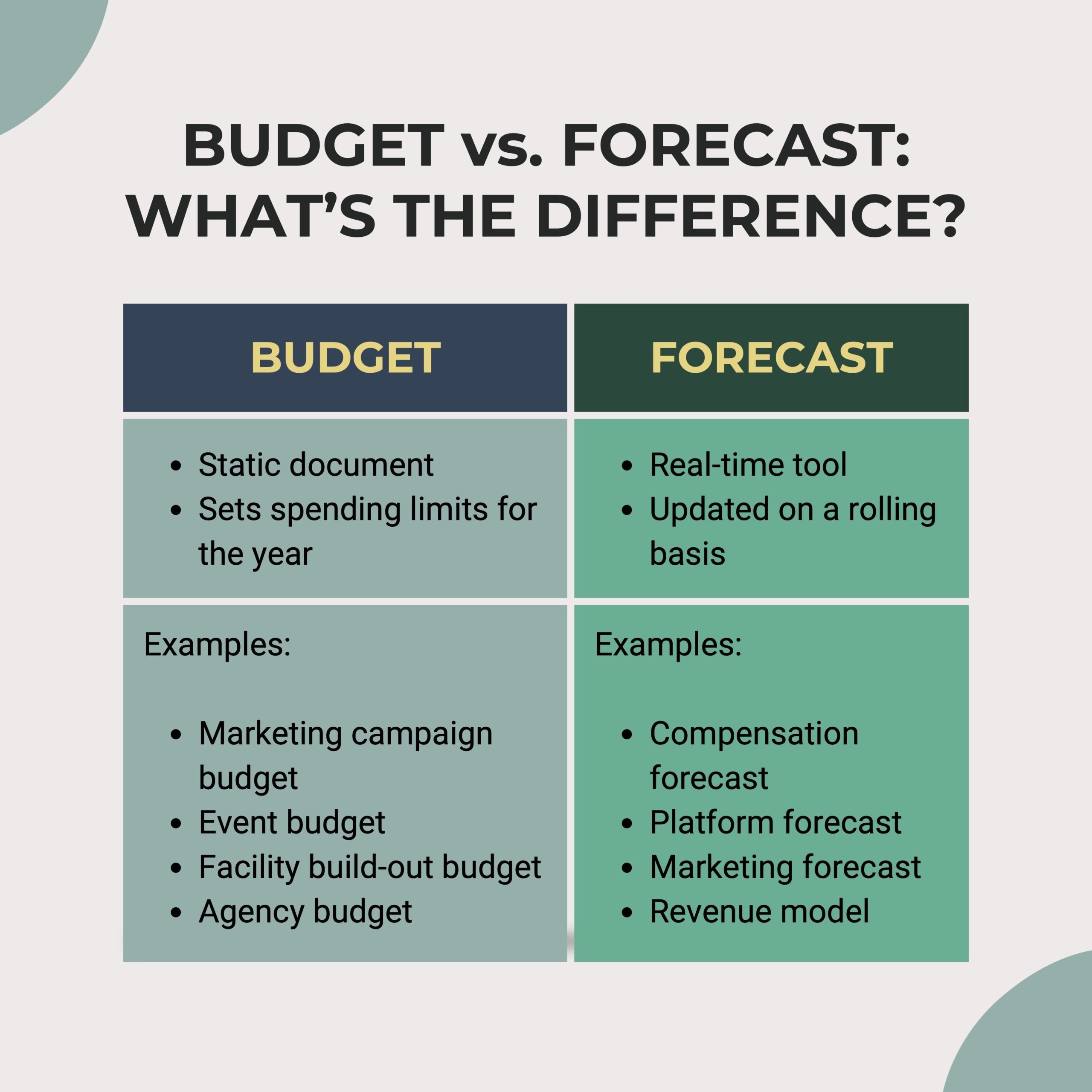

The difference between budget and forecast is that a budget is a fairly static document often used to set spending limits, while a forecast is a more real-time tool that gets updated on a rolling basis. Both are financial tools used to reflect the results of your strategic plans.

The terms budget and forecast are sometimes used interchangeably, but they’re not quite the same. Startup founders will give themselves a great start by understanding the differences between a budget and forecast.

Running your startup without a budget or forecast is a lot like packing a suitcase for a trip you know nothing about.

Imagine I invited you on this trip but didn’t give you any more information. How would you even begin to pack? You don’t know the length of your stay, where you’re going, what the weather’s like, etc.

Without a plan, you’ll likely bring a lot of stuff you don’t need while forgetting some essentials. You might go out and buy a fleece-lined parka, only to find out you’re enjoying a tropical beach vacation. Perhaps you don’t bring your work laptop, but then discover that on the beach, we’re meeting with several high-profile investors.

Early-stage companies that operate without a financial plan run the risk of misallocating resources, wasting time and failing to align on business goals. Proper budgeting and forecasting, on the other hand, spurs resource efficiency, acceleration of timelines, accountability, and the versatility to adapt on the fly with data-driven insights.

Financial Forecasting Template

Table of Contents

- What Is a Budget?

- Types of Budgets

- What Is a Forecast?

- Types of Forecasts

- Key Budget vs. Forecast Takeaways

What Is a Budget?

A budget is a financial plan that reflects the results of the strategic plan if executed exactly as modeled over the fiscal year. It is rigid and can be interpreted as the limits for spending. Many of us are familiar with the question, “Is this in budget?” when making purchase decisions. In the startup world, there are many more factors that should be considered.

As with all financial plans, budgets facilitate accountability for financial results. They are generated before the start of the fiscal year and are usually updated semi-annually or quarterly. Budgets stay more static than their cousin, the forecast.

High-growth companies should align goals with their budgets but also be aware that circumstances change quickly. Agility, responsiveness and adaptation are key characteristics of a successful startup, so it’s best to use a financial model that shares those attributes.

Types of Budgets

The major types of budgets include:

- Marketing Campaign Budget

- Event Budget

- Facility Build-Out Budget

- Agency Budget

Budgets are useful for focused, well-defined, short-term initiatives. They’re perfect for events with pre-determined start and end dates.

Because of their static nature, budgets can be handled by individual contributors — unlike forecasts, which are typically managed by company leaders. Here are a few examples of budgets:

Marketing Campaign Budget

Let’s say you’re planning a marketing campaign for Q1 of next year. All of your activities — LinkedIn ad spend, paid media, hours billed to freelancers, etc. — should fall within this budget.

Event Budget

It’s often helpful to outline a budget for an event or conference. The event budget will include room for a booth reservation, flights, airlines, meals and more. Budgeting ensures your participants are staying within reason — and not buying a first-class flight and the most expensive bottle of wine on the company dime.

Facility Build-Out Budget

Whether you’re renovating an old facility or building a new one, a budget will come in handy. Furniture, electrical work and other construction can get pricey, so you want to set expectations beforehand.

Agency Budget

Agency spend is a good example of a budget that can be dedicated in terms of a percentage of a variable target. Many startups will spend a certain percentage of their revenue on agency work for marketing, advertising, consulting and more.

What Is a Forecast?

A forecast is a financial tool that reflects real-time estimates of financial results based on dynamic execution of your strategic plan. High-growth companies with a long-term lens — such as startups — will benefit from sound forecasting.

The forecast is updated more frequently than the budget — usually monthly or quarterly. Often it’s presented as a rolling forecast, which operates on a rolling 12-month period rather than a calendar year.

The forecast can be used as a tool to guide business operations and dynamic strategic decisions, including scenario analysis, merger and acquisition decisions, pricing and packaging strategy, optimal product mix and response to unforeseen external factors.

How does a forecast relate to the different types of financial models? Forecasting is a company’s way of preparing for the future by determining expectations. Startup financial modeling involves taking the predictions from a forecast and incorporating real-life numbers from the company’s financial statements. This produces a predictive model to guide decision-making.

Types of Forecasts

The major types of forecasts include:

- Compensation Forecast

- Platform Spend Forecast

- Marketing Spend Forecast

- Revenue Forecast/Revenue Model

The idea of forecasting all revenue and expenses can be daunting. That’s why it’s helpful to break your forecasts up into logical groups of spend or earnings. These sub-forecasts will share the same set of assumptions. You’re just breaking up the larger picture into bite-sized pieces that are easier to generate.

Compensation Forecast

This covers staff compensation: salaries, employer taxes, bonuses, raise schedule, etc.

Platform Spend Forecast

Most startups have a multitude of SaaS platforms and tools. Map out your spending on these tools to make sure you’re only paying for what you need.

Marketing Spend Forecast

Marketing spend is far-reaching and includes paid advertisements, freelancer contributions, award submissions, audiovisual equipment and more.

Revenue Forecast/Revenue Model

Not all forecasting is expense related. You can also forecast your revenue by building a comprehensive revenue model. This way, you’ll have a better understanding of how bookings will be attained and the costs associated with hitting your revenue targets.

Key Budget vs. Forecast Takeaways

Remember: Budgeting and forecasting aren’t the same thing! They’re both useful in certain scenarios. Budgets are a great tool to control how you allocate resources to shorter-term projects, and for individual contributors. Forecasts are more flexible and help with long-term planning.

Together, these tools will help you track and manage your startup’s revenue and expenses.