Mastercard this week announced the acquisition of identity verification company Ekata for a reported $850 million. Mastercard is expected to combine its existing fraud detection solutions with Ekata’s unique scoring approach in order to advance its identity detection capabilities and create what it says will be a, “safer, seamless way for consumers to prove who they say they are in the new digital economy.”

Why This Transaction?

The York IE team chose this as our transaction of the week to explore exponential growth in the digital economy fueled by the pandemic. Unsurprisingly, as the bulk of global transactions have shifted online, the need for robust and secure identity verification tools is now more important than ever. Recognizing the shift to digital across nearly every vertical, Mastercard has made a forward-looking decision by acquiring Ekata in an effort to bolster its identity verification tools. Using a unique scoring method, which essentially gives each merchant a “credit score” for their identity, Ekata will bring a new level of security to Mastercard’s arsenal of fraud detection tools. As the global and digital economy continues to expand, we expect to see an increasing number of opportunities for ID verification solutions to enter the market; pair this with the fact that we will likely continue to see more stringent regulations and compliance requirements, and it is not hard to understand how the ID verification market is expected to reach a size of $15.8 billion by 2025. Although the sophistication and frequency of cyber-attacks and fraudulent transactions have increased in recent years, so too, have the advancements in preventative/defensive solutions with the help of technologies such as artificial intelligence, machine learning and automation.

Growing Need for Identity Verification Tools

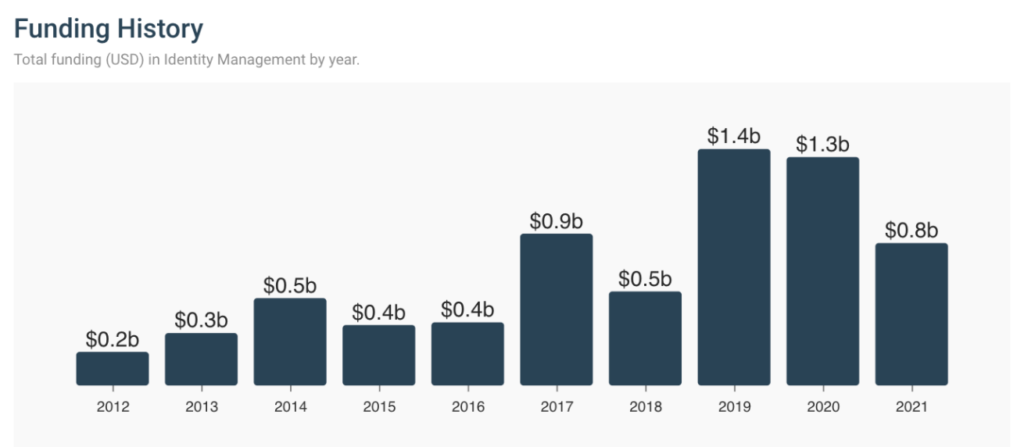

The identity verification market is experiencing a paradigm shift from legacy manual ID verification systems to electronic credentialing systems. With regulators continuing to crack down on compliance for things like know your customer (KYC) and anti-money laundering (AML), merchants across all industries are looking for ways to ensure the integrity and security of their transactions. Recognizing this dynamic change in the market, the York IE team collected data related to funding in the ID verification market which has a direct correlation with the growth of ID verification:

As you can see in the graph above, this market has seen increased funding activity since 2019 and is already on pace for 2021 to be the highest funding year to date. Understandably, this funding and the growth in the digital economy are directly correlated as investors see the need for ID verification solutions moving forward. In our opinion, we expect this to continue into the future and see more room for growth in this market as the global digital economy continues to expand at a staggering pace.