Last week, RedHat announced a definitive agreement to acquire StackRox for an undisclosed amount. StackRox, the first Kubernetes-native security platform, is expected to integrate seamlessly with RedHat’s Kubernetes platform OpenShift; the partnership will allow OpenShift users to securely build, deploy and run cloud-native applications across their Kubernetes clusters. Purchased in 2018 for $34B, RedHat was part of IBM’s shift toward hybrid cloud management; using OpenShift, IBM created cloud architecture that works with the entire range of IT infrastructure, regardless of the clients’ vendor.

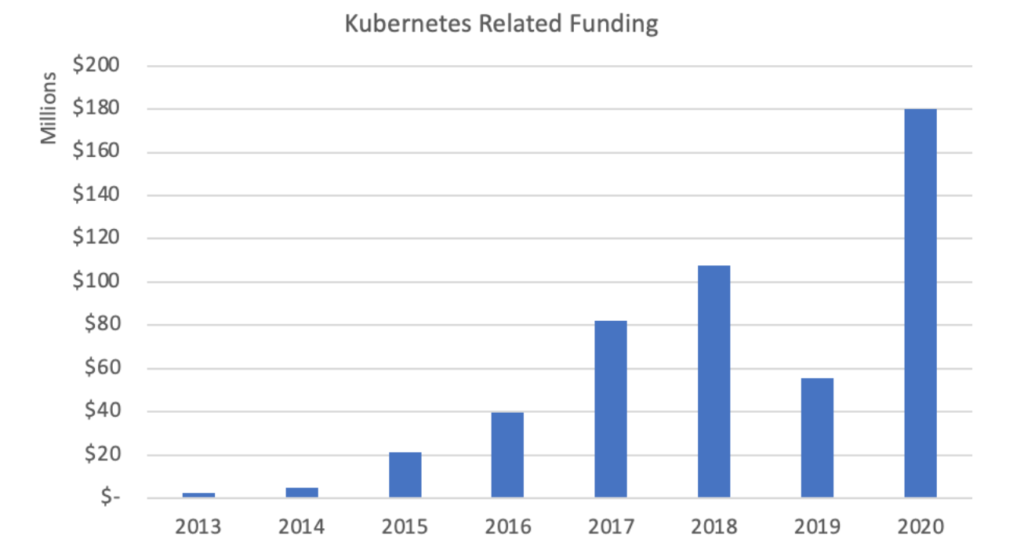

The data above paints a clear picture of the level of the recent capital being deployed into the Kubernetes market; Q4 alone saw more than $115M invested into Kubernetes related companies bringing the 2020 total to $180B. This massive growth in the last quarter alone is a clear indication of where the market is heading; with adoption nearing 90% we expect a handful of large enterprises to continue diversifying their Kubernetes toolkits through acquisition.

The data above paints a clear picture of the level of the recent capital being deployed into the Kubernetes market; Q4 alone saw more than $115M invested into Kubernetes related companies bringing the 2020 total to $180B. This massive growth in the last quarter alone is a clear indication of where the market is heading; with adoption nearing 90% we expect a handful of large enterprises to continue diversifying their Kubernetes toolkits through acquisition.

Why this transaction?

The York IE team chose this as our transaction of the week to discuss consolidation within the Kubernetes market. In a previous TOW, we explained how the COVID pandemic has been a watershed moment for StackRox as the company raised a $26.5M Series C after experiencing 240% revenue growth for 2020. With market adoption of Kubernetes nearing 90%, large enterprise technology companies like IBM are pursuing acquisitions to grow their respective market share. Organizations continue to deploy into hybrid and multi-cloud environments, using a combination of both private and public cloud, which requires flexible and vendor-neutral solutions. By leveraging their RedHat and StackRox acquisitions, IBM will continue delivering hybrid cloud architectures that can be deployed anywhere; subsequently, OpenShift customers gain innovative security measures, via StackRox, for their Kubernetes clusters. In 2019, Palo Alto Networks completed a similar deal in which they purchased Twistlock and PureSec, two container security startups, adding the highly valuable asset of container security to their toolkit. As hybrid and multi-cloud environments continue to expand, large technology enterprises will continue to acquire Kubernetes solutions in an attempt to control market share and diversify their toolkit.A Banner Year For Kubernetes Investments

In a previous TOW blog we showed you Kubernetes related funding information dating back to 2015; the graph we showed you indicated that as of Q3 2020, funding in Kubernetes had reached the $65M mark. In the final quarter of 2020, market consolidation ramped up as enterprises continued to acquire niche Kubernetes solutions. With this in mind, the York IE team decided to update our previous graph to include funding information for Q4 2020: The data above paints a clear picture of the level of the recent capital being deployed into the Kubernetes market; Q4 alone saw more than $115M invested into Kubernetes related companies bringing the 2020 total to $180B. This massive growth in the last quarter alone is a clear indication of where the market is heading; with adoption nearing 90% we expect a handful of large enterprises to continue diversifying their Kubernetes toolkits through acquisition.

The data above paints a clear picture of the level of the recent capital being deployed into the Kubernetes market; Q4 alone saw more than $115M invested into Kubernetes related companies bringing the 2020 total to $180B. This massive growth in the last quarter alone is a clear indication of where the market is heading; with adoption nearing 90% we expect a handful of large enterprises to continue diversifying their Kubernetes toolkits through acquisition.