If you’re building a B2B SaaS company, you’re hoping your platform can solve a problem for customers and add value to their business every single day. Seeking out SaaS funding from investors and venture capital firms gives you an opportunity to scale your product — and ultimately get it in front of more customers.

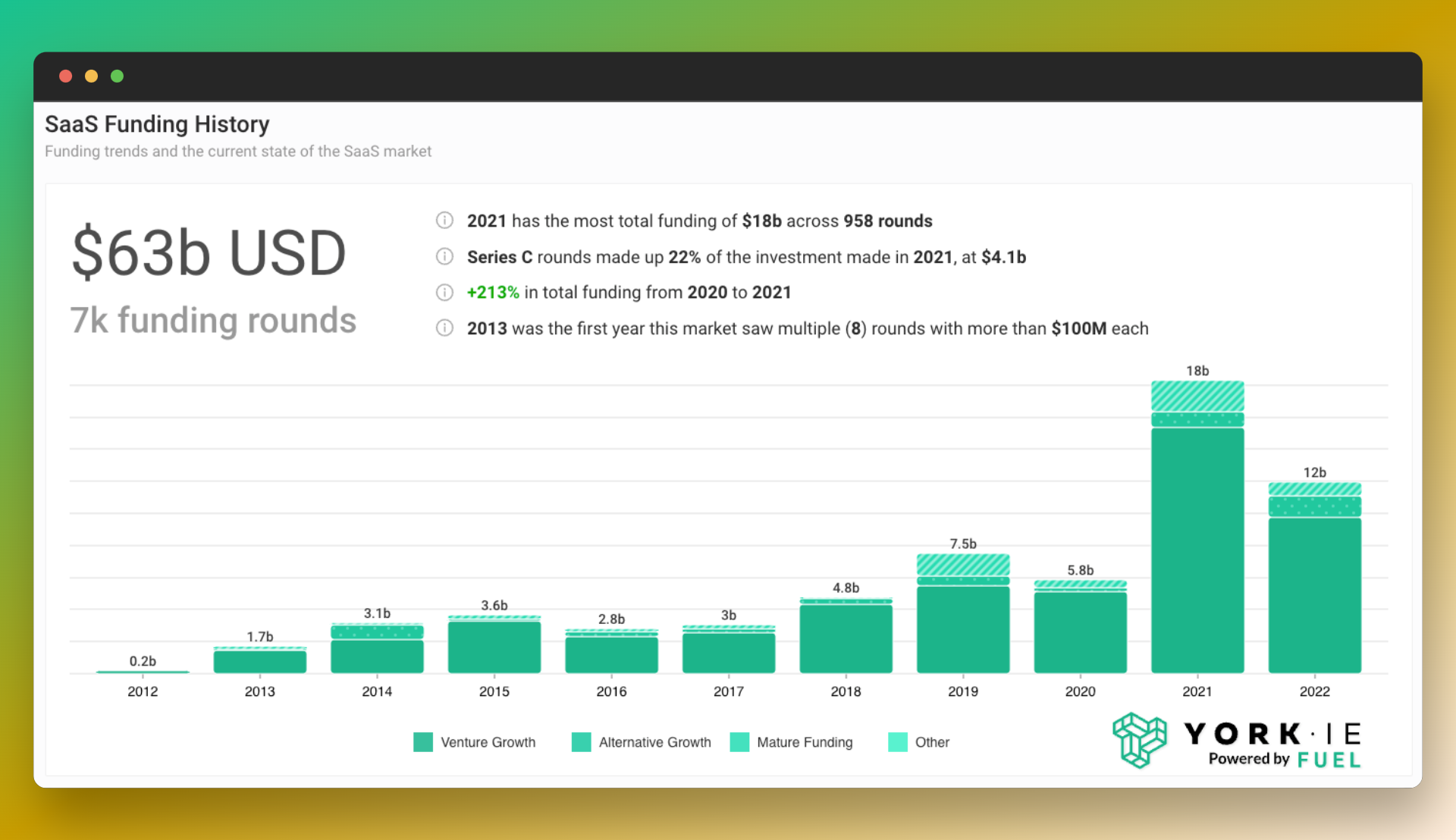

Software as a Service is an extremely hot market; SaaS startups raised $15 billion in venture funding in 2021 — a 3X year-over-year increase — according to York IE Fuel.

To secure funding in this ultra-competitive market, you’ll first need to show potential investors some traction with early customers and a clear plan for spending new capital. It’s important to know how to differentiate your SaaS startup and approach investors with an appealing pitch. There are also a few different forms of SaaS funding that could be tied to your startup’s equity or revenue.

Here are the answers to a few key questions about SaaS startup funding:

Does Your SaaS Startup Need Funding?

SaaS companies are attractive to investors for two main reasons: recurring revenue and low costs for development/distribution.

Most SaaS startups generate recurring revenue through a subscription-based or usage-based model. There’s generally more predictability with these revenue models because customers are making consistent payments to the company over an extended period of time. Of course, your SaaS startup has to prioritize customer success to retain or even reacquire your clients.

The cost of app development and distribution is generally lower for SaaS companies as compared to consumer packaged goods, hardware or biotech companies. You don’t need large factories to produce your product. Once it is developed by your engineering team, it’s relatively inexpensive to add new customers. Most of the work is done up front, as you don’t need to recreate your software each time.

That doesn’t mean every SaaS company appeals to investors, though. Before you seek out SaaS funding, it’s important to check a few boxes:

A Better Way to Build Your Startup

Want to work with investors who care about growth, not vanity metrics?

Signs of Product Market Fit

Product market fit is essential. If you’re looking for a seed-stage SaaS investment, it’s important to have proof or data to show that the customer problem you have identified is real. You then should have some level of adoption, which shows that the product you’ve built is solving that problem for some small cohort of potential customers.

A Plan for Spending New Capital

Investors want to see that you’re going to put their money to good use. It’s important to have specific goals for any startup funding: opening a new office, hiring two new engineers, recruiting a head of sales, etc. Don’t raise money just for the sake of it; you’re effectively selling a piece of your company every time you take on outside capital.

GTM Focus

At York IE, our seed-stage investments are typically past the ideation stage. Your SaaS offering can even be a minimum viable product, but you need something tangible.

Once your product is developed, you can make the best use of SaaS funding. That’s where you begin building your go-to-market strategy: hiring early sales leaders, attending events, content marketing, etc.

Types of SaaS Funding Available

There are two main categories of SaaS funding: venture capital (traditional investing) and loans or debt financing. Each category has a couple of different structures.

Venture Capital/Traditional Investing

Venture capital is one of the more common avenues to securing SaaS funding. At York IE, we operate a lot like a VC on the front end, but because we don’t charge fees to our limited partners, our incentives are aligned more closely with the entrepreneur.

Traditional investing can be split into two categories:

Priced Equity Round

This is the most traditional structure for startup funding and York IE’s preference. You’ll effectively trade a percentage of your company for investor capital.

SAFE

With a simple agreement for future equity (SAFE), the investor gets their shares only if/when the SAFE converts after the next qualified financing. The price of the shares is then based on the valuation in that subsequent round of funding.

Loans/Debt Financing

The advantage of taking on debt is that generally speaking, you won’t have to give up nearly as much equity (if any). That of course, depends on the terms of your loan — and you’ll have to account for other costs, as well:

Revenue-Based Financing

Once you’ve grown a little past the seed stage (roughly $3 million to $5 million in annual recurring revenue), you’ll be able to engage with revenue-based financing firms such as Bigfoot Capital. Your payment back to the lender is directly tied to a percentage of future revenue.

Venture Debt

Venture debt is less tied to your revenue and more tied to a holistic valuation of your SaaS startup. Your startup will pay back your loan (plus interest), and the firm or bank will likely have the right to buy equity at a discounted rate in the future.

3 Steps to Get SaaS Startup Funding

Once you’ve identified the need for startup funding — and explored your options — it’s time to start finding some investors. Here are some key steps to securing your next fundraising check:

1. Show Your Founder Market Fit

Be prepared to show why you and your leadership team are the right people to solve the problem you’ve identified. Consider your experience, credibility and network within your market.

2. Know Your Data

Especially as you mature, sound financial metrics such as growth rate, gross margins and cash flow are important to investors. Know these numbers and emphasize your strongest ones. If you’re in the earlier stages, make sure you’ve identified loyal customers or influencers that can speak to your product.

3. Seek Out SaaS-Specific Investors

There’s a large ecosystem of investors that have SaaS startups as part of their portfolios. There are also many investors that invest only in SaaS. Conduct some investor research to find a firm that matches with your stage and market — but also find the people that complement your skills and add value to your company.

Not all SaaS funding is made equal. Try to team up with an investor that understands the SaaS scaling journey. They’ll become a trusted advisor that can help you through the good times and bad.

York IE invests in B2B SaaS startups and other early-stage companies. Explore our investment opportunities.