TL;DR

- I’m excited to announce the launch of York IE

- York IE is a hybrid strategic advisory, investment, and operational growth firm focused on scaling innovative, creative and impactful companies via several unique engagements and vehicles. We invest capital, expertise, and passion, build products and create content to support ambitious entrepreneurs and angel investors on their quest to scale startups and disrupt markets.

- Kyle York, Joe Raczka and Adam Coughlin are managing partners. Our entire amazing team can be found here.

- We have already invested in more than 60 companies and had 16 exits, including Fastly’s billion dollar plus IPO.

- Our expertise in scaling Dyn to $100M Annual Recurring Revenue, 5,000 enterprise customers, 1M paid users, 500 loyal employees, $100M venture capital raised, 11 acquisitions and one epic exit to Oracle serves as our foundation.

- Our vision is to reshape the way startups are built, scaled and monetized

- Our mission is to build a meaningful hybrid advising/investment/operating firm entrepreneurs and other angel investors love to work with that drives jobs, generational wealth and long-game impact.

- Please join newsletter to stay up-to-date with our latest investments and our original content

I’ve worked for 36 years to write this blog. So I apologize in advance if I get a little long-winded. I have a lot to say. So here we go!

Today I am happy to announce the official launch of York IE.

Now you may be wondering: what the heck is York IE? Great question.

York IE, in many ways, is the culmination of the career experiences I have had over the past 20 years. From playing “work” as a child to running west coast sales and biz dev for WhippleHill to scaling Dyn into a global brand to jumpstarting Oracle’s cloud business, I have learned four universal truths about myself:

- I’m most passionate when working with entrepreneurs and startups.

- I love building teams and collaborating with people who challenge me to be better.

- I like to win. I love when everyone wins.

- I care about my legacy and the impact I can create.

As my days at Oracle began to wind down, I knew I needed a new challenge. I also knew I was fortunate to be in a position where I could play by my own rules and imagine the type of job I have longed dreamed for. As I thought about what would be most rewarding and play to those above requirements, the answer became very clear: I had already been doing it.

For the past five years or so I have been an active angel investor. While juggling a full-time job and a growing family, I have invested in more than 60 startup companies. That may seem crazy but I love it. I love when an entrepreneur calls me because he or she is facing a challenge and is stuck. I love watching coachable founders blossom before my eyes and ultimately teach me. I love working in the flow – context switching from one company; one industry to another. I can never shut off my brain. I go to bed late and wake up early because mentoring, looking for new opportunities, doing deals, pulling levers, solving problems – all of the things that go into helping a startup grow – makes me feel alive. It’s my passion.

I’ve decided to stop doing my passion 1% of the time and instead formalize my angel investing and startup advising into a day job. But I know myself. I know I would never be happy writing checks and sending entrepreneurs on their way only to check in next quarter. I like getting my hands dirty. I like working for my money. I like betting on myself. And so I thought there could be a new type of angel investing firm. One that broadened the definition of an investment beyond money to include time, resources, passion and expertise. Entrepreneurs have always worn many hats. I felt like it was time for an investment firm to do the same thing. I felt if I offered everything I’ve learned in my career to the companies I backed, in whatever form they needed that help, that would add value and accelerate their growth (personally and professionally). Outside my parents, friends and family… could I create the work mentorship and support system I wish I had on my rise?

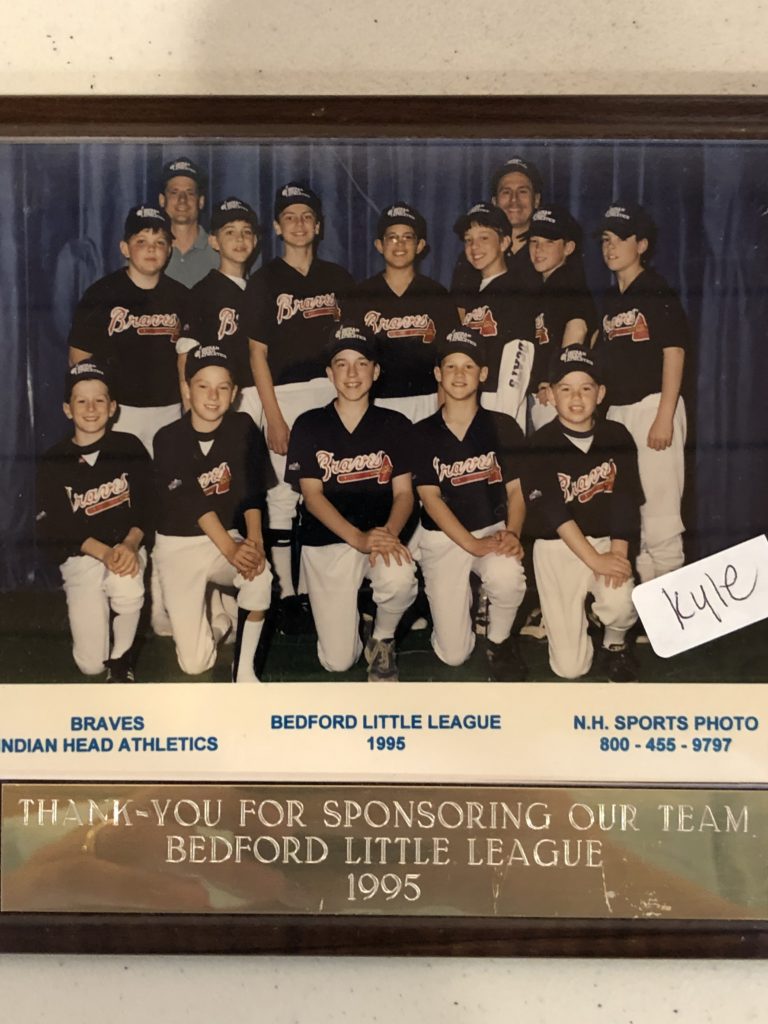

I also knew I couldn’t do that alone. I needed a team that I trusted and believed in. Fortunately, I knew exactly where to turn. I am proud to announce that my long time friends, collaborators and brain trust, Joe Raczka and Adam Coughlin, are joining me as Managing Partners in York IE. Adam and I became best friends in kindergarten and we both met Joe as teammates on the little league baseball field in our hometown. Our relationships transcend business.

Joe is bringing his expertise in finance and corporate development with his stellar rolodex to every startup we talk to sharing knowledge on everything from monetization strategy, pricing/packaging, strategic partnerships, M&A and fundraising. Adam is the Ernest Hemingway of corporate storytelling. He has an ability to cut through the noise and create a clear and compelling brand voice. He can make the most confusing technology relatable and easily understood.

I would trust either of these guys with my life. There was no better example of this trust then a 12-hour window back in 2016. On the evening of October 20th, Joe and I were celebrating. We had just signed the Letter Of Intent for Dyn to be acquired by Oracle. It was the culmination of a grueling and arduous process that challenged us both. But we were proud of the end result and knew it would change lives within our community. The next morning I had a very different conversation with Adam. Dyn was under one of the largest and most complicated cyber attacks in history and I told him how important it was that we nailed our response. By the end of that day, we had come out OK and were, in fact, lauded for the way we handled the crisis. That 12-hour whirlwind encapsulated everything. In good times and bad (and in startups and technology those can be only 12 hours apart), we’ve all been there for each other and haven’t just survived but thrived.

Ashley Oberg, my long-time executive assistant, who actually runs much of my business and personal life, will be with us too. She is our business manager making sure this machine runs smoothly. Ashley is the owner of Barre Life in Manchester and is as sharp and passionate an entrepreneur as I’ve met. Rounding out our team are Marshall Everson who will be working from our Boston office and will be our tip of the spear into new relationships and investments. His title is Vice President, but he’s so much more. Our only Ivy leaguer. On his team is Ryan Brown, our young and hungry recent college graduate who is devouring every trend happening in the market and making us all a bit smarter each and every day. Last, but certainly not least, we will soon be announcing an amazing hire for our VP, Product Strategy, and Head of York IE Labs. Stay tuned!

Why would an investment firm have a Labs division? Another great question (and thanks for still reading)! One of my biggest fears was to become what many investors and board members become: older guys or gals who had success years ago but have fallen out of the game. I never wanted to say (in an old man voice): “Back when I was at Dyn, using carrier pigeons was a great marketing tactic for us.” Thanks, grandpa.

At York IE we want to remain operators. We want to stay fresh. We’re also obsessed with adding value. So we will be working on building products for entrepreneurs and angel investors that can help them solve the early stage problems they face. We’ll be offering some of these products as open source while others we’ll be selling. Some will also spin out into brand new scaling startups. Yep, we want to build a SaaS business (many, actually!) as we help other entrepreneurs do the same. It’s how we’ll remain relevant over the years and actually bring real-world value to our investments.

And as we’re out there on the front lines meeting with entrepreneurs, we’ll be taking the lessons we learned and producing content so we can benefit the thousands of entrepreneurs out there we don’t have the bandwidth to talk to directly. We believe that rising tides raise all boats and that by arming the next generation of entrepreneurs with the lessons we’re all learning along the way, we’re actually seed investing in the future.

But we’re not just focused on entrepreneurs. As I said like 4,000 words ago, I love angel investing. I want to bring that passion to others as well. I want to expose others to this tremendous and invigorating asset class. We want to democratize angel investing and open it up to a broader swath of people that understand the high risk, high reward nature of the opportunity. We believe the more people angel investing responsibly means we can all have a bigger impact on building a healthy economy. If you’re an accredited investor join our SaaS syndicate (and the Scout Syndicate for even earlier bets). Be exposed to the deals we believe in. Welcome to the party.

It’s going to be a hell of a party.

And it’ll be happening in our beloved New Hampshire. Our HQ is in the Cigar Building in downtown Manchester. Why? Because we built our careers in New Hampshire. We don’t live in the Silicon Valley echo chamber. We want to build good companies, not just fast exits. We think differently and understand how to build good businesses that solve real customer problems. We are firm believers in doing it ‘our way.’ At Dyn, we helped run the internet. So we believe in its power of connectivity. The businesses of the future will be everywhere. We’re going to help entrepreneurs build their company on their own terms. We’ll also have a Boston office on Summer St. to better connect Northern New England tech to the amazing Boston innovation scene.

And I know we can do this and have a huge impact. Our hybrid approach is one of a kind and that focus on being unique will make all the difference. With that, Joe, Adam and I firmly believe that legacy lasts longer than wealth. Making money isn’t awesome in and of itself. It is a worthwhile pursuit because of what it affords you to do. We think that investing in startups is the best way to truly impact a community. Successful startups create jobs, train and grow the workforce and donate to traditional charities. They also show our kids that corporate America in all of it’s aspirational appeal isn’t the place for the hungry, the change agents, the rebel rousers and the game changers.

Join us and let’s go make an impact.