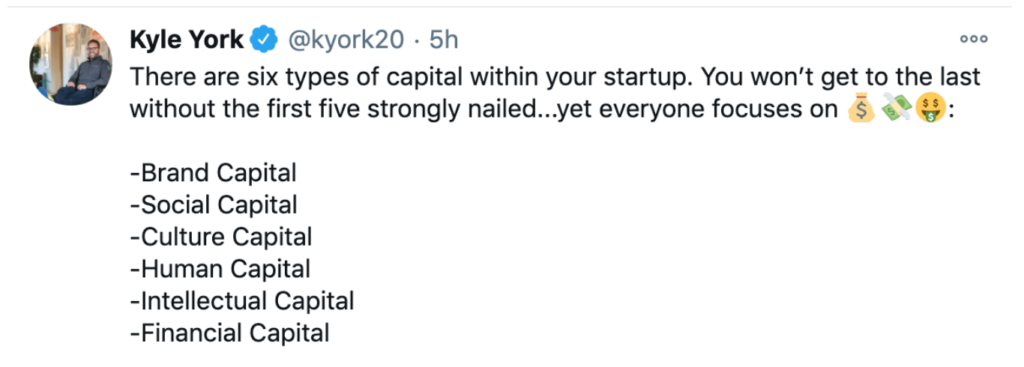

I recently dropped a tweet that I wanted to expand upon about the different types of capital that make up a company.

The first five are equally if not more important than financial capital, but yet they often exist in the shadows of success.

I’ve talked at length about how in the startup world all the vanity metrics get celebrated as there has become an obsession and even celebrity around venture capitalists, founders, venture funds, funding rounds, private valuations, exits, IPOs and everything else that comes with financial capital. This is all great momentum for the space, yet so often the mundane, disciplined, pure, and foundational forms of capital are overlooked and underappreciated.

There is very little out there covered about the other types of capital, so let me expand. It’s important because as a founder or executive of a growth company, you truly will never conquer the financial side of capital until you nail the other core types of capital that fuel your business.

Brand Capital

The worth of your startup’s brand is driven by how you measure your community engagement.

To calculate that worth, start with adding up all your followers across your owned channels like Twitter, Facebook or LinkedIn. How many people subscribe to your email? How many visit your website? Then dive deeper and ask yourself, how many people are you reaching with each social post, blog or video?

It takes a lot of time and effort for people to start recognizing your brand. It takes a constant drumbeat of storytelling and sharing to evolve your startup’s leadership position in the market. Brand capital is also about your personal brand as a leader. Your company brand begins with what your personal brand is built upon. I guarantee the first followers of your startup’s brand will come directly from your personal brand.

Social Capital

Your social capital is your network. Are you constantly building your network? Is your company highly engaged with your community?

You need your voice to reach others in your space, whether it is from emails, Zoom meetings, phone calls, social media, through connections or at (virtual) events. Social capital is one of the most important types of capital. There is immense value, and everyone involved benefits — founder to founder, startup to startup.

I always say that people buy from people they like and they stick with companies if they enjoy doing business with them. That transcends your product or technology or user experience. You know the saying: “It’s not about what you know, it’s about who you know.”

Culture Capital

Your startup needs to set a culture.

Much like the New England Patriots, each team or company has a certain culture. The Patriots’ culture is all about doing your job to the best of your ability. There is no one person that is the hero.

Culture starts with the owner, the coach, the leader, the CEO, the founders to set a certain standard of how to act and how to work. Your company’s culture will either attract talent or repel it. It is so important to have a healthy, welcoming culture so people enjoy working at your startup.

Culture is in values, not in beer and ping pong. Remember that as you invest in what makes you tick.

Human Capital

Simply put, you should invest in people before anything else.

Human capital is the economic value of an employee’s skills and knowledge. Too often the talent in a business can be viewed transactionally or as “find and replace.”

Find your cultural leaders. Embrace them, empower them and hold onto them. They transcend corporate hierarchy. Who do you envision working for your startup? What type of employee is going to be the reason why you experience growth? How do you drive your core cultural norms and tenets through these people as you scale?

Your people are your most important asset and must be treated as such.

Intellectual Capital

Intellectual capital is your secret sauce — differentiates you from your competition.

What do you know and do that gives you an edge over your competitors? Are you the most prepared in your market? It isn’t all about knowledge. You need to live in your space, gain experience that provides you with different perspectives and be willing to do what others aren’t.

It’s not so much your mental aptitude but your mentality that makes or breaks a company. So often your intellectual capital works its way into your technical innovation. But it’s important to also realize that innovation isn’t only a technology advantage. There are so many things that can become your moat.

Financial Capital

Financial capital will come in time, but it is all about nailing down the other five types of capital first. It isn’t easy, and it takes years of dedication and playing the long game.

In the end, you don’t get to fundraising or profitability or exits only for money’s sake. It really can’t only be about financial capital. It’s about the journey of gaining and solidifying the other five: the brand, community, environment, people, the experiences. That’s when you truly find success.